What else do we expect stocks to do other than rise? Stocks indexes are regularly rebalanced to reflect upward drift. Investor may feel the pain of large corrections and bear markets along the way but stocks will rise for the next 100 or even 200 years (you can pick the duration), assuming stocks markets are not replaced by a different scheme.

I saw an article linked to a tweet yesterday claiming that stocks could rise for 10-15 years. I agree but why only 10-15 years? Stocks could rise for 20, 50 or 100 more years. This is what stocks do; they rise as a group, as long as there is wealth creation and innovation.

I have also claimed in the past that bull market calls are not interesting because given the longer-term upward drift in the market, the odds of being correct are high. I have called these forecasts “The Charlatan’s Narrative”. This is the link to a more recent article regarding these bullish forecasts made by charlatans.

Actually, investors would like to know when a large correction should be expected rather than whether the market will go up in the next 10 or 100 years. However, as it turns out, forecasting market tops is a fair coin toss. Some that were successful in the past, apparently by chance, failed in subsequent attempts.

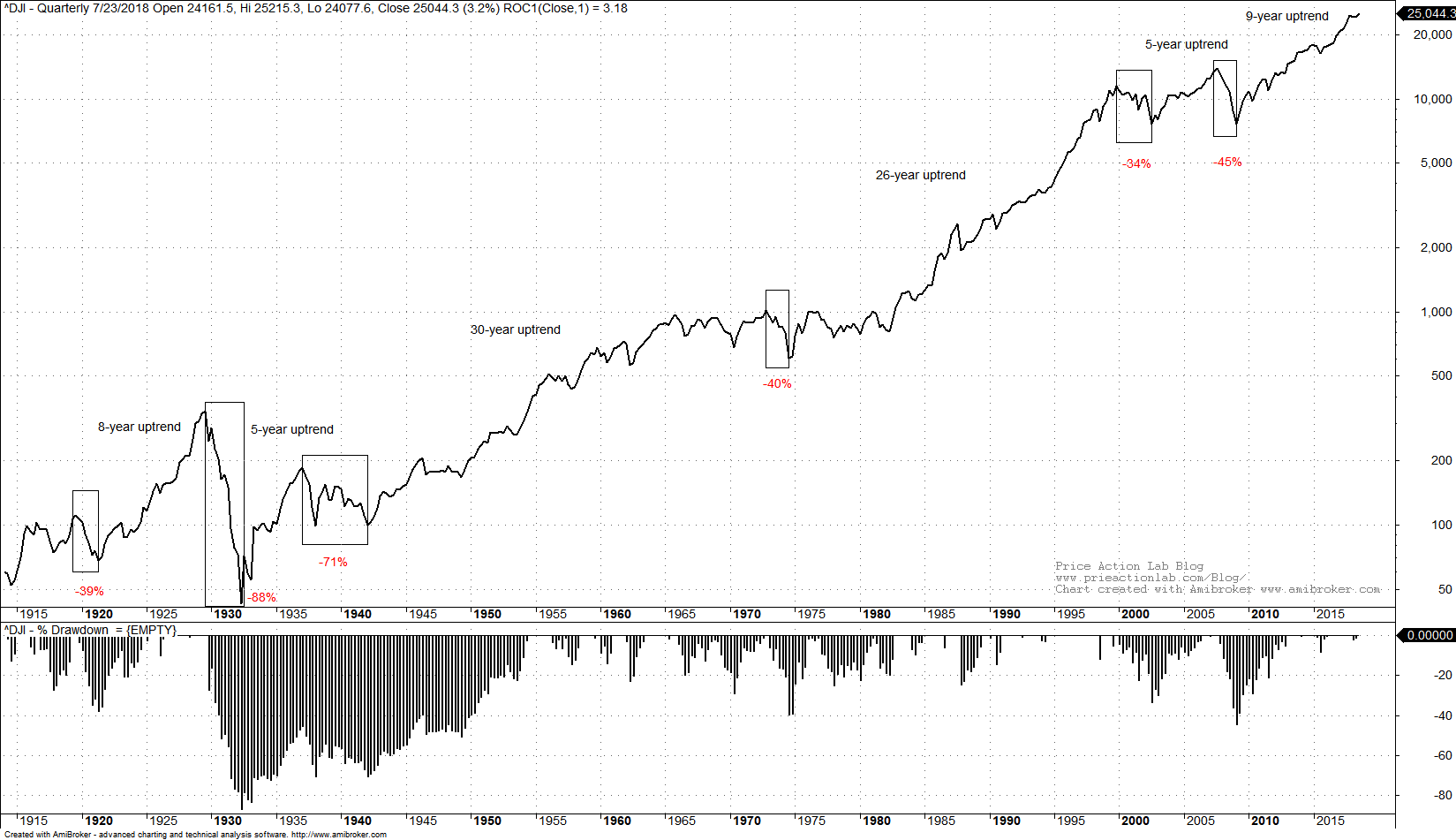

Below is a quarterly Dow chart since 1915. I have marked on it six major corrections, the size of maximum drawdown and the duration of subsequent uptrends. Click on image to enlarge.

Despite the six major corrections that include the Great Depression with a drawdown of about -88% and the financial crisis at -45%, the index recently made new all-time highs. Why not expect a rise of 100 more years despite any large corrections?

We can calculate the expected drawdown as the weighted drawdown by the number of years in subsequent uptrend. This comes out to -54%. The expected duration of an uptrend after a correction is calculated in a similar way to be about 14 years. But these averages are not very useful because variance is large. What investors need to know is when to buy protection or reduce risk. Only a few famous investors have been able to to this successfully and it is possible that they were just lucky.

Bullish forecasts are not very useful because even people that have no real connection with the stock market understand that by nature of this game, stock indexes will always be going up as long as the rules remain the same. So I am surprised when I hear professionasl saying that the market could rise in the next year or 10 years,. Of course it could rise. The odds that the market will rise next year are about 2:60 to 1. This is not very enlightening. The value is in bear market forecasts but their success rate is terrible. So what to do given these realities?

These are a few facts to understand:

- Stock markets will always rise due to enforced construction and central bank support

- Stock markets will always inflict pain to investors due to black swans

- There is no way to predict tops or bottoms

and some opinions next

4. Always have some cash on the sideline

5. Never use leverage since maximum drawdown may exceed 50%

6. If you are not skilled in the art of trading, contact a competent financial adviser

If you found this article interesting, I invite you follow this blog via any of the methods below.

Subscribe via RSS or Email, or follow us on Twitter

If you have any questions or comments, happy to connect on Twitter: @mikeharrisNY

Charting and backtesting program: Amibroker

Technical and quantitative analysis of Dow-30 stocks and 30 popular ETFs is included in our WeeklyPremium Report. Market signals for longer-term traders are offered by our premium Market Signalsservice. Mean-reversion signals for short-term SPY traders are provided in our Mean Reversion report.