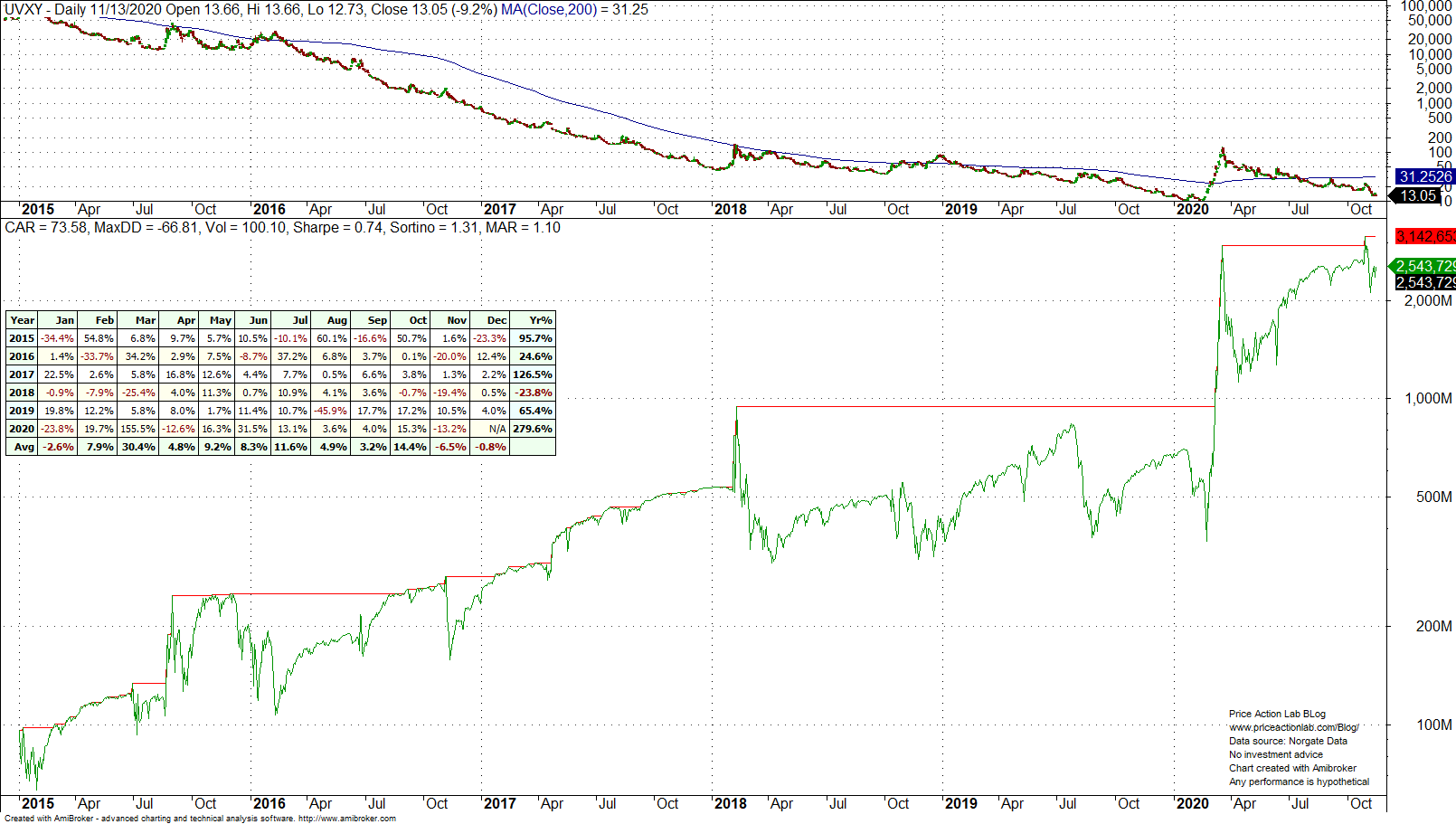

Anyone trading volatility and not realizing a return of at least 100% this year is probably doing it wrong. The simple strategy mentioned in this article is up 280% year-to-day. The last few years have been a volatility trading paradise.

This simple strategy was fully disclosed in a recent premium article. Below is the backtest equity curve and monthly returns from 01/02/2015 to 11/13/2020 (no commissions included.)

CAGR is about 73% since 2015! However, for reasons discussed in more detail in the quoted premium article, we do not trade this strategy. Actually, we have never traded any volatility products due to their high risks. Volatility ETPs are derivatives of derivatives of derivatives but provide high profit potential to those who are comfortable with the high risks and that mostly includes very experienced traders with good knowledge of risk and money management. Anyone how does not belong in this category should contact a certified financial adviser before considering trading high risk volatility ETPs.

Charting and backtesting program: Amibroker

Data provider: Norgate Data

If you found this article interesting, you may follow this blog via push notifications, RSS or Email, or in Twitter