NASDAQ-100 registered on Thursday, February 24, 2022, the largest gain from open to close in the last 14 years. The index opened 3.3% below the previous close but ended the day with a gain of 3.4%.

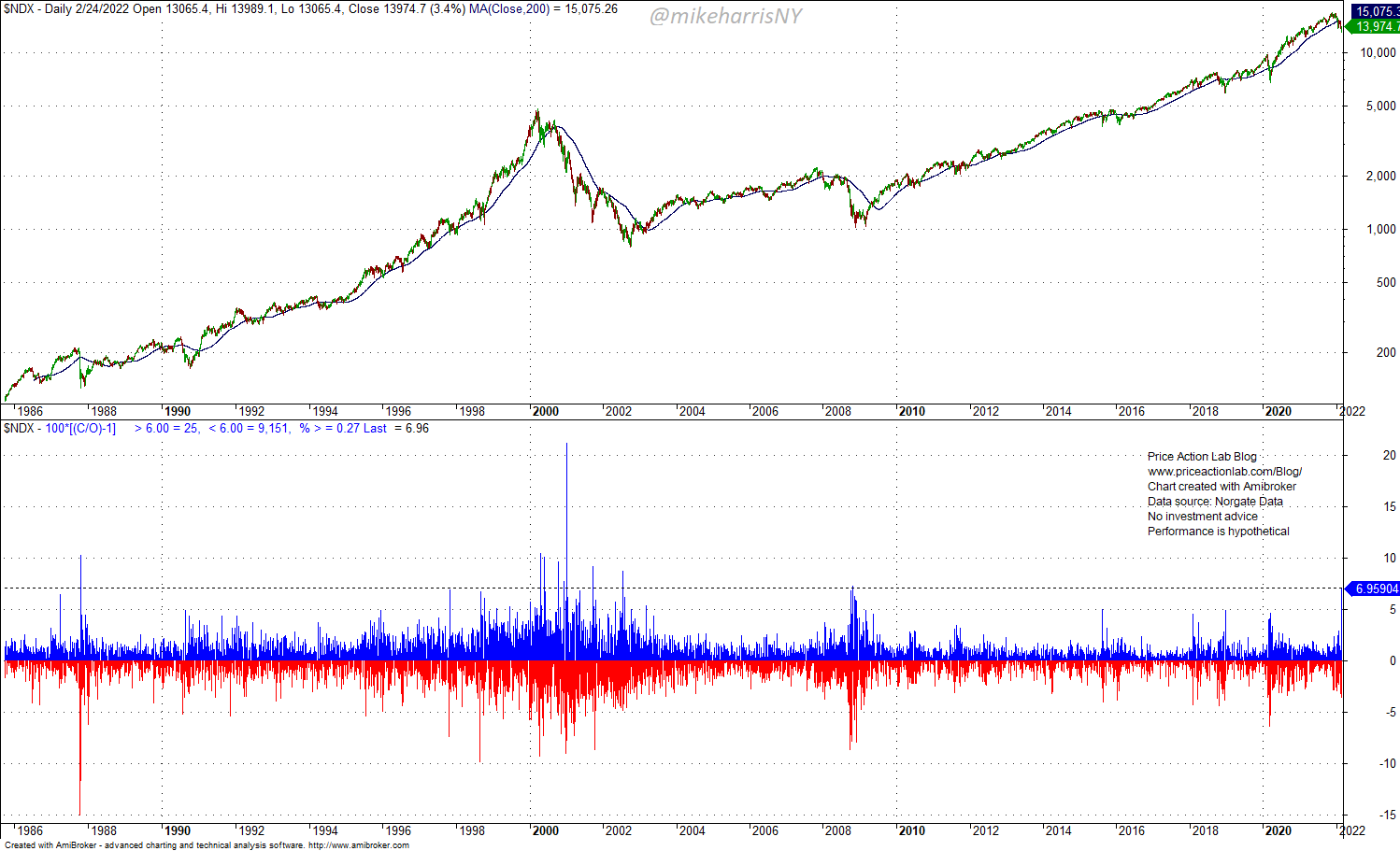

The High-Low range for the day was 7.1%. The gain from the gap down open was the largest since October 28, 2008, as shown below.

As many traders know, these large reversals usually occur during large corrections and bear markets and are either due to profit taking from short positions or short squeezes, or both. Rarely, these large reversals signal a bottom.

The chart below shows that there have been only four other occasions since inception of NASDAQ-100 index with an open lower than 2% and a close higher than 2%.

Two of those events occurred long before the bottom of dot com bear market, one near the bottom and another one near the bottom of 2008. After all four events, the market went down but less in the case of those that occurred near the bottoms. Therefore, these large reversal indicate stress in the markets but nothing about a bottom, it’s usually a coin toss.

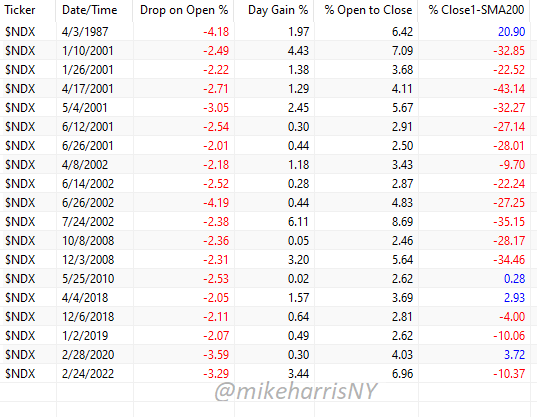

Below is a table of all occurrences of 2% drops from the open followed by positive close, in NASDAQ-100.

There have been 14 such events and only four occurred when price was above the 200-day moving average. Note that the largest reversal was 8.7% on July 24, 2002, when the index gained 6.1% after falling 2.4% on the open.

Premium Content 10% off for blog readers and Twitter followers with coupon NOW10

Disclaimer: No part of the analysis in this blog constitutes a trade recommendation. The past performance of any trading system or methodology is not necessarily indicative of future results. Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS or Email, or in Twitter.