About 42% of SPY ETF total return since inception on January 29, 1993, is due to dividend reinvestment. This has important ramifications: (a) Stock market is nowhere near a bubble state, (b) if you do not reinvest dividends, then all the reported long-term stock market performance are irrelevant to you and (c) the high impact of dividends minimizes risk of uncle point.

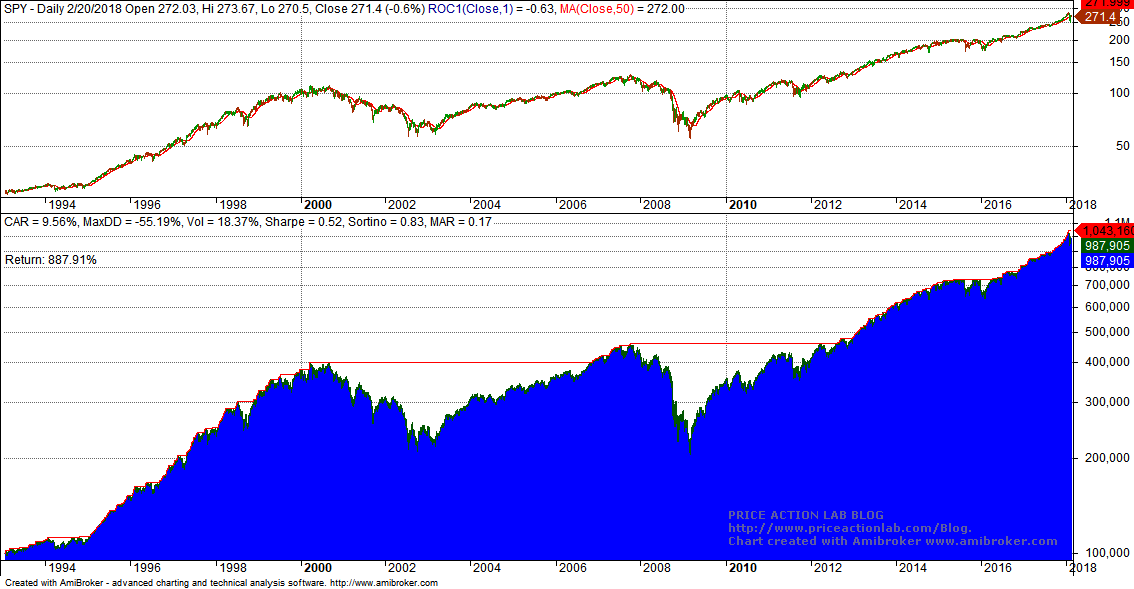

Below is the SPY total return with dividend reinvestment:

Total return since inception is 887.91%, CAGR is 9.56% and Sharpe is only 0.52 due to relatively high volatility of 18.37%. MAR is a mere 0.17.

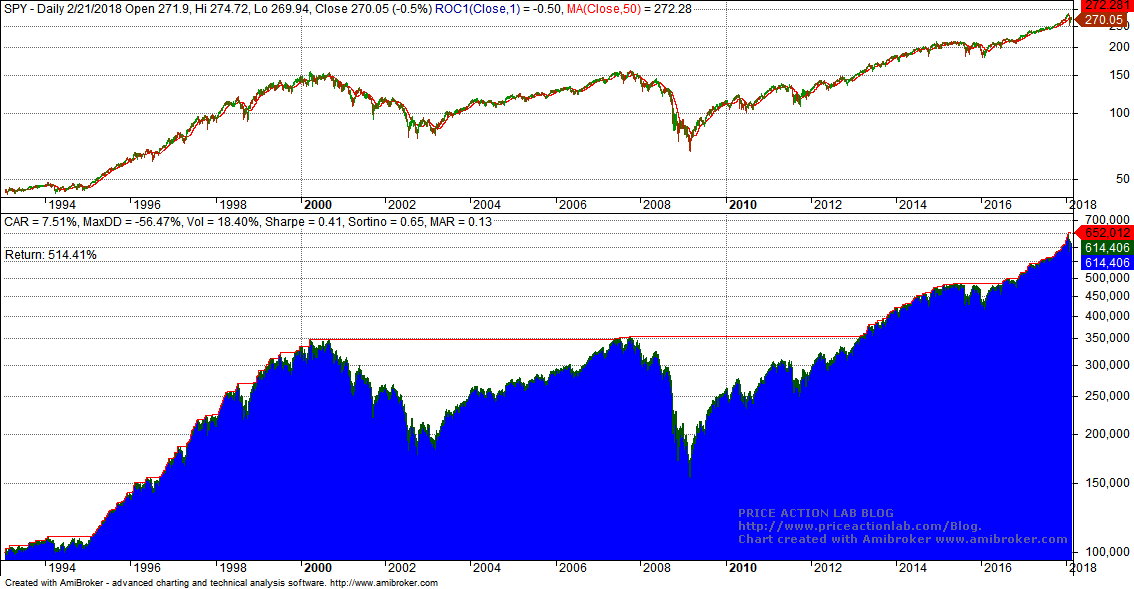

Below is the buy and hold without dividend reinvestment:

Return since inception is 514.41%, CAGR is 7.51% and Sharpe is only 0.41 due to relatively high volatility of 18.40%. MAR is a mere 0.13.

The above results show that about 42% of SPY total return, or about 373%, is due to dividend reinvestment. if dividends are not reinvested, performance will be nowhere close to that usually reported in financial media.

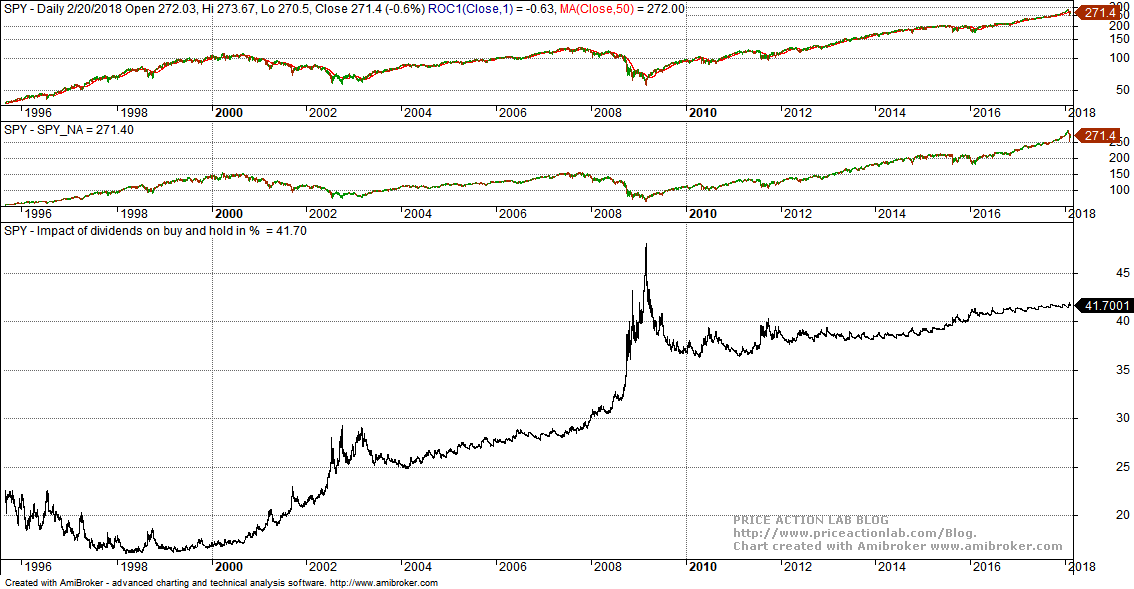

Below is the impact of dividends on total return as a percentage:

The impact of dividends on total return was naturally lower in the first years after inception of SPY but rose rapidly to more than 46% near the bottom of the financial crisis. Obviously, the effect is bigger during falling prices and in bear markets. In the last ten years this impact has been stable with a small upward drift. Nevertheless, it is a a large contribution that indicates that prices are nowhere near a bubble market given that nearly half of the total return can be attributed to dividends.

Below are results of a Monte Carlo simulation of maximum drawdown levels based on equity curve changes, for adjusted SPY on the left and unadjusted on the right:

|  |

In the case of dividend adjusted data, the probability of a drawdown larger than 60% is 5%. This probability increases to about 12% for unadjusted data. This means that reinvesting dividends reduces probability of uncle point, as expected.

As a comparison, below are the same simulations for EEM on the left and SVXY on the right.

|  |

The probability of a 60% or larger drawdown in the case of EEM is about 35%. In the case of SVXY it is more than 85% as also expected due to the nature of this ETP.

The conclusion is that high reinvested dividends lower risk of uncle point and limit bubble formations. However, for these to be true, dividends must be reinvested.

If you found this article interesting, I invite you to follow this blog via any of these methods: RSS or Email, or follow us on Twitter

If you have any questions or comments, happy to connect on Twitter: @mikeharrisNY

Charting and backtesting program: Amibroker

Quantitative analysis of Dow-30 stocks and 30 popular ETFs is included in our Weekly Premium Report. Market signals for longer-term traders are offered by our premium Market Signals service. Mean-reversion signals for short-term SPY traders are provided in our Mean Reversion report.