Weekly Signals Updates include open positions, new signals and performance of six systematic trading strategies. Click here for more details about the strategies. Access to report requires Market Signals or All in One subscriptions.

Market Recap and Comments (January 31 – February 4, 2022)

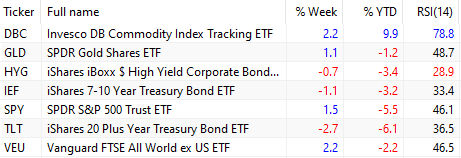

Stocks (SPY) rebounded nearly 4% by Wednesday but ended the week of their highs with a gain of 1.5%. Commodities (DBC) gained 2.2%. Gold (GLD) ended the week up 1.1%. Bonds (TLT) fell 2.7%. Year-to-date, DBC is up +9.9%. TLT is down the most at -6.1%. DBC is overbought and High Yield Corporate Bond (HYG) is oversold.

All strategies gained on the week. Dow 30 long/short strategy gained 1.1% and it is up 4.4% year-to-date. Mean-reversion in SPY gained the most (+1.5%). Four strategies outperform S&P 500 year-to-date. However, all strategies are in the red year-to-date except Dow 30 long/short.

I’ll refrain from making a short-term forecast because although the rebound was strong and there are some technical signals that point to a potential bottom, there are specific sources of risk at this juncture that weren’t present in the past. There are conflicting signals about interest rates and inflation, there were several tail events in large cap stocks and there is also a significant increase in options volume that renders forecasts based solely on price and its derivatives quite hard. Therefore, I’ll let the strategies run the show because trying to outsmart the market can become a disappointing endeavor at this point.

Strategy positions and performance as of close of Friday, February 4, 2022.

|

This post is for paid subscribers

Already a subscriber? Sign in |

Disclaimer: The Premium and Weekly Signals are provided for informational purposes only and do not constitute investment advice. We do not warrant the accuracy, completeness, fitness or timeliness for any particular purposes of the Premium and Weekly Signals. Under no circumstances the Premium or Weekly Signals should be treated as financial advice. The author of this website is not a registered financial adviser. Before subscribing please read our Disclaimer and Terms and Conditions.

Copyright notice: Any unauthorized copy, reproduction, distribution, publication, display, modification, or transmission of any part of this report is strictly prohibited without prior written permission.

10% off for blog readers and Twitter followers with coupon NOW10