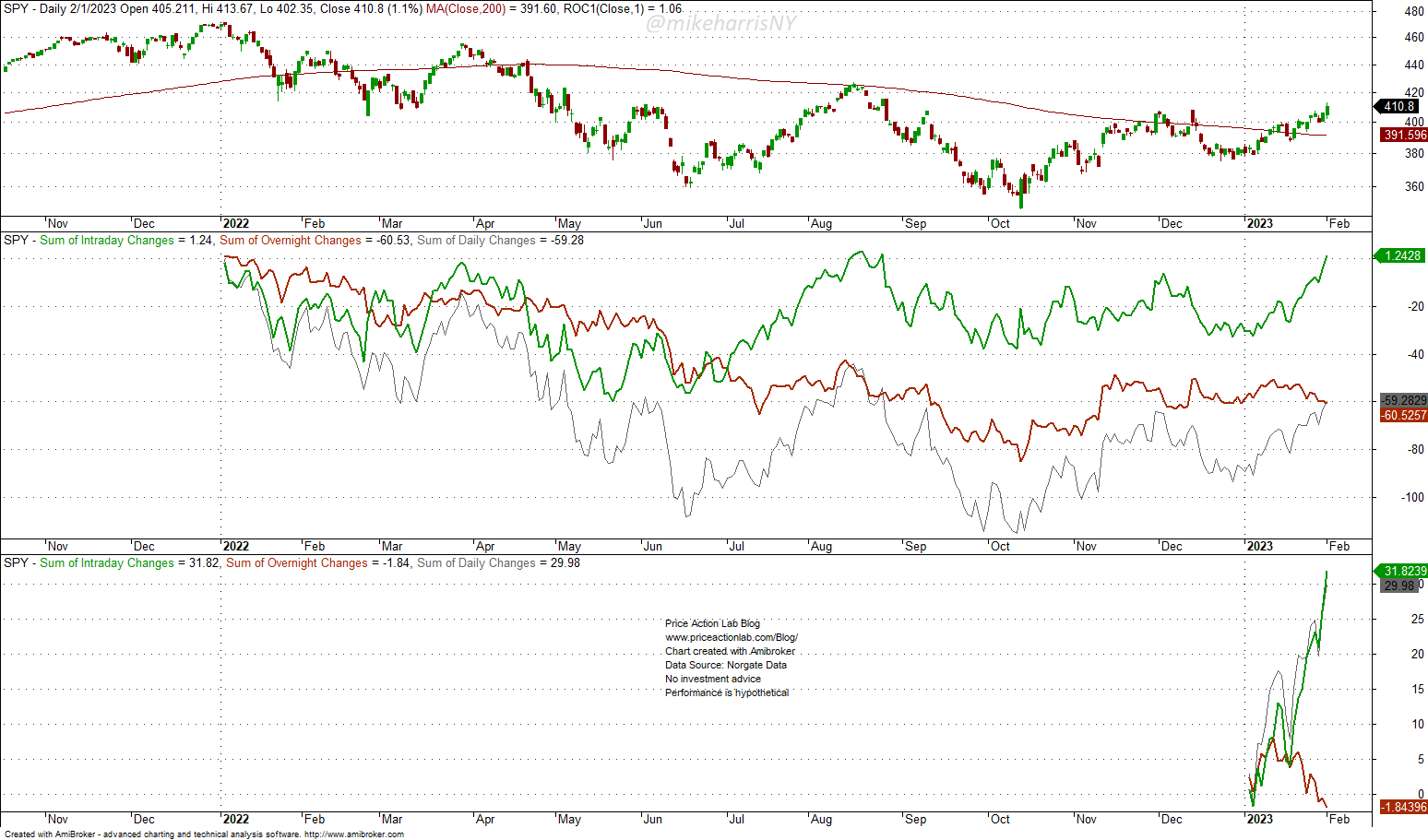

Gains in the US stock market from regular trading hours since January 2022 turned positive while there are still significant losses from overnight changes. A regime change has occurred.

In an article last month, I argued that the overnight effect is fading away after providing most of the gain in the US stock market for about three decades.

After the market reversal yesterday, February 1, 2023, due to the Fed’s decision to reduce rate hikes to 25 basis points and dovish interpretations by many analysts, the regular trading hours gains since 2022 turned positive as compared to a large loss from overnight changes.

Specifically, since January 3, 2022, the SPY ETF has gained $1.24 in regular trading hours (green line) versus a loss of $60.52 due to overnight night changes (red line). This is a huge spread in favor of regular trading hours.

Year-to-date, the SPY ETF is up 7.4% and all of the gains have been realized during regular trading hours, from the open to the close of trading days, or $31.82 versus a loss of $1.84 overnight.

This significant regime change could be related to increased options trading activity during regular trading hours and especially in 0DTE options.

The overnight effect is fading away after the recent publicity it has received, and this is the typical evolution path of most anomalies when the trade gets crowded.

10% off all premium content, strategies, and software, with Discount Code NOW10. Click here to subscribe.

By subscribing you have immediate access to hundreds of articles. Premium Insights subscribers have immediate access to more than a hundred articles and All in One subscribers have access to all premium articles, books, premium insights, and market signals content.

Subscribe for free notifications of new posts and updates from the Price Action Lab Blog and get the PDF book “Profitability and Systematic Trading” (Wiley, 2008) free of charge.

Disclaimer: No part of the analysis in this blog constitutes a trade recommendation. The past performance of any trading system or methodology is not necessarily indicative of future results. Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data