Our strategy for CTA replication (REPA) does not rely on an index to replicate the performance. It is a bottom-up replication strategy instead of a top-down one.

Most of the time, CTA replication strategies use statistical analysis or machine learning to infer CTA positions based on the performance of an index, such as the SG Trend index or the SG CTA index. This may be viewed as a top-down approach.

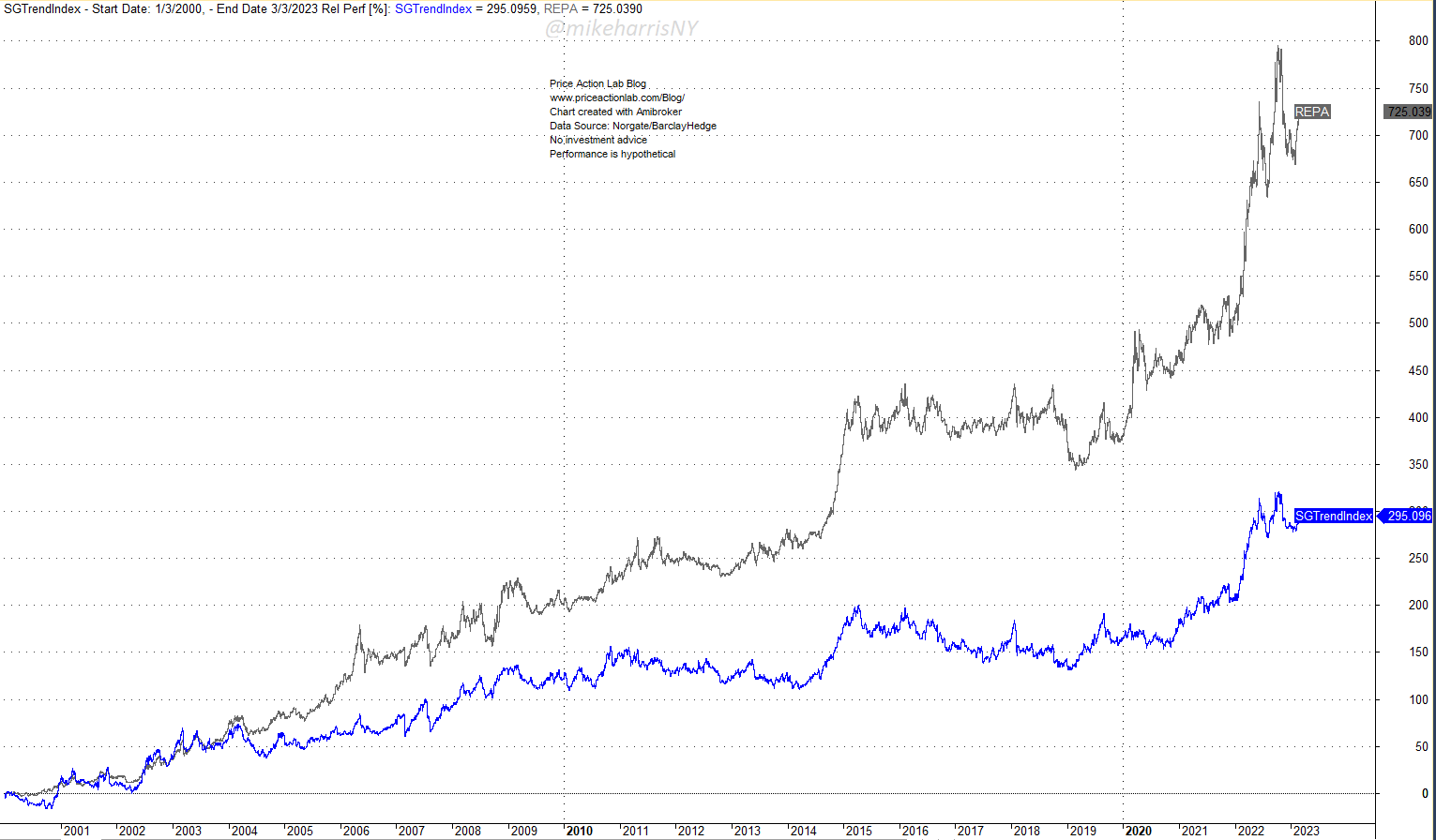

A bottom-up approach is to try to infer CTA positioning from the price action in the markets, with the additional objective of improving the performance during long flat periods, such as the “Lost Decade” from 2009 to 2018. If we already know that the ensemble of CTAs has lost a decade due to the high dispersion in performance, it may make no sense to pursue top-down index replication but a more promising bottom-up approach. This is what we have accomplished through the use of a relatively simple trend-following strategy that trades 26 liquid futures contracts. Below is the relative performance of our bottom-up replication strategy (REPA) and the SG Trend Index during the “Lost Decade.”

The SG Index performance is actual and net of fees, whereas the REPA performance is hypothetical and based on backtests.

The total return of REPA in the lost decade was 53%, versus 3.7% for the SG Trend Index. The CAGR and maximum drawdown for REPA are 4.5% and -12%, versus 0.4% and -21.8% for the index.

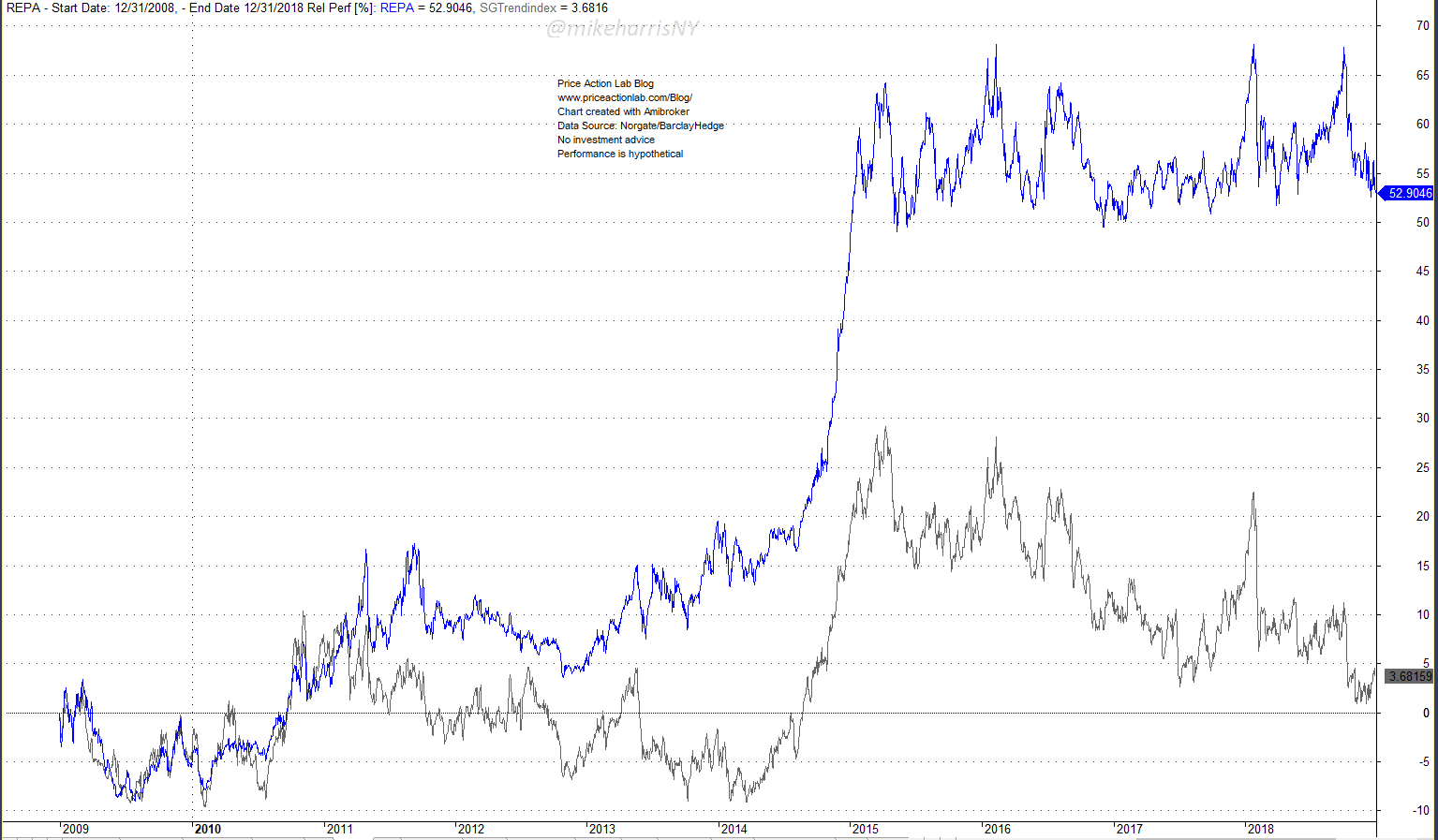

Below are the equity curves of the REPA and SG Index from 01/03/2000 to 03/03/2023. The 0-lag, 252-day correlation is also shown.

The black line is the SG Trend Index, and the red line is REPA. The minimum 0-lag, 252-day correlation has been 0.48 and the maximum 0.90, while the average is at 0.78.

Our objective was not only to replicate CTA returns but also to outperform the index. Below is the relative performance of the REPA and SG Trend Index from 01/03/2000 to 03/03/2023.

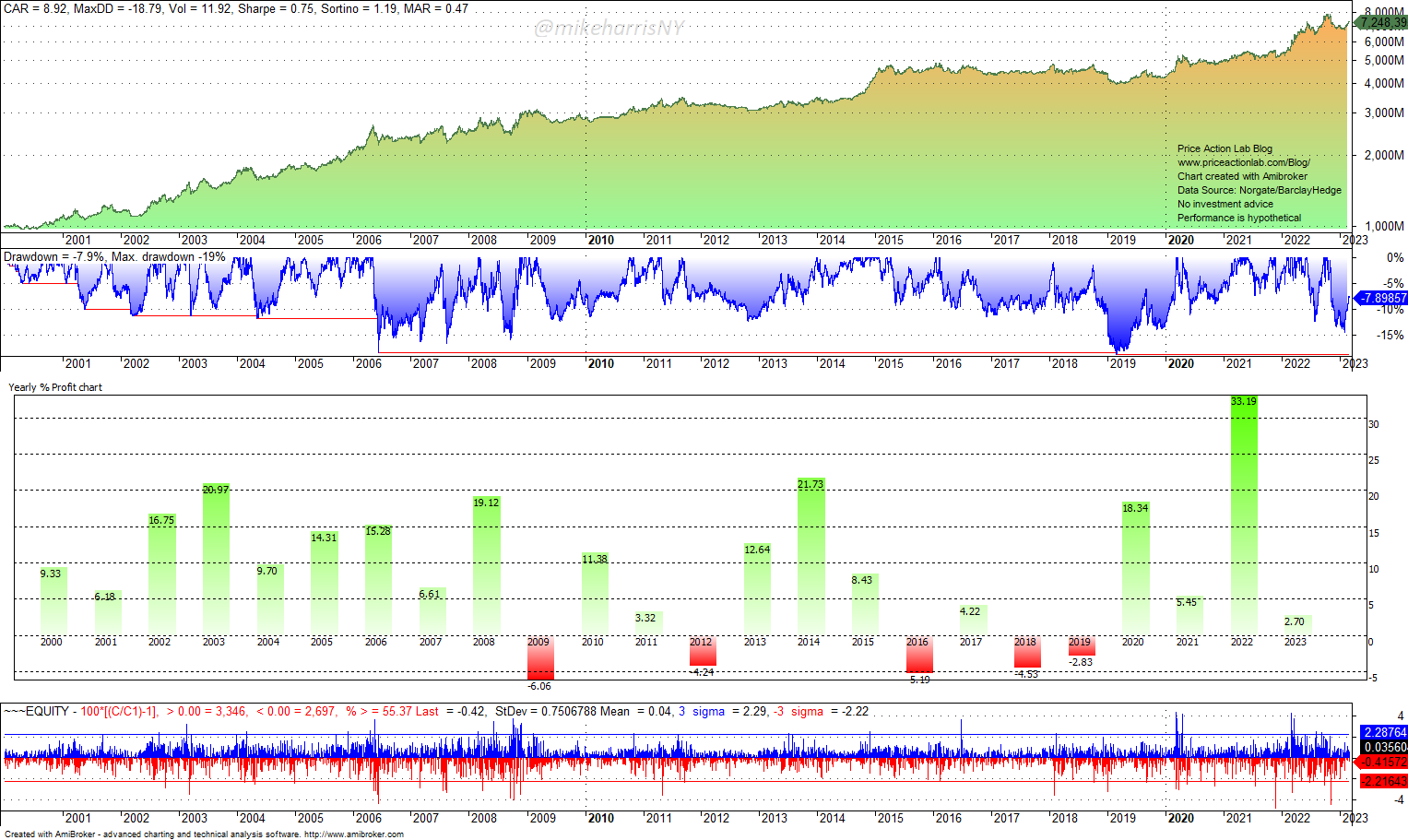

Below is the performance of REPA, including yearly returns, drawdown profile, and daily return histogram.

The annualized return of REPA is 8.9%, the maximum drawdown is 18.8%, and the Sharpe is 0.75. Last year, the strategy had its best return.

This is a strategy suitable only for hedge funds due to their high capitalization requirements. The high capitalization requirements also act as an entry barrier to this type of strategy. Top-down replication strategies have low capitalization requirements but may stop tracking an index or suffer from volatility drag. However, top-down is more suitable for developing exchange-traded products due to its lower complexity. We also include a minimal version of the replication strategy that can be used with lower capitalization requirements.

The rules of the strategy are available for sale. Contact us for details.

Here is a description of the REPA strategy, including the markets it is used in and the minimum amount of capital it needs. Subscribers to REPA can access the protected content.

|

This post is for paid subscribers

Already a subscriber? Sign in |

Risks of CTA Replication Strategies

CTA bottom-up replication strategies attempt to capture extended trends in markets, also referred to as outlier trades, and also track, or outperform, related indexes. Due to these strategies using stop-losses, the win rate is low because the strategies exit with a loss until a trend starts. This style of trading requires a high level of discipline. The strategies are fundamentally simple, and any alpha comes from their systematic approach to trading the markets.

Click here for a list of all strategies.

Disclaimer: No part of the analysis in this blog constitutes a trade recommendation. The past performance of any trading system or methodology is not necessarily indicative of future results. Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS or Email, or on Twitter