Some make more, some less, but in this casino, all gamblers win. All it takes is tossing a fair coin. This casino is the S&P 500 index total return.

Consider the SPY ETF, which has closely tracked the S&P 500 total return at a cost of less than ten basis points. Toss a fair coin at the end of each month. If the outcome of the toss is heads, stay invested in the SPY ETF. If the outcome of the coin toss is tails, go to cash. Repeat tossing the fair coin at the end of every month.

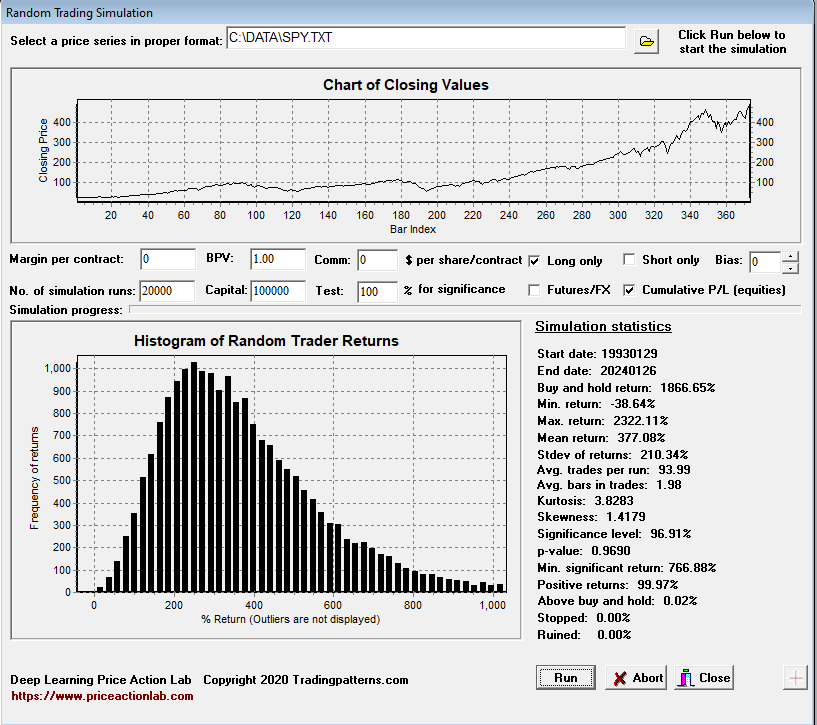

I repeated the above simulation for SPY ETF monthly data from inception on January 23, 1993, to January 26, 2024. Below is the histogram of the total return for 20,000 independent players. The available equity is fully invested after calculating the allowable number of shares. This is supposed to be a game of chance, but as it turns out, it has not been one.

The simulation revealed that 99.97% of the random investors, as described above, made money. Although only a few made more than the buy-and-hold total return of 1867%, the average return was 377%. This translates to an average annualized return of around 5%, which is higher than what some strategic allocations have offered. The average maximum drawdown has been about 37%, which is much lower than the maximum drawdown of the SPY ETF of about 55%. The median values are approximately equal to the average values, by the way.

Is there a game of chance (a fair coin toss) where nearly everyone has made money? Yes, this is the US stock market. Investors who toss a fair coin every month, which is essentially what everyone does despite using technical or macroeconomic analysis, with a small bias or not, have realized a 5% annualized return at a much lower maximum drawdown on average. Caveat emptor: these gains are before commissions and taxes.

For those who like statistics, notice the positive skew of 1.42. Also notice that a significant return (p-value 0.05) would require realizing a total return of 767%, or an annualized return of about 7.2%. How many hedge funds or traders have generated a 7.2% annualized return over a period of 31 years? Nothing beats a casino, where nearly all gamblers win.

Premium Content

No hype or gloom-and-doom

Market analysis based on 30 years of skin-in-the-game

By subscribing, you have immediate access to hundreds of articles. Premium Articles subscribers have immediate access to more than two hundred articles, and All in One subscribers have access to all premium articles, books, premium insights, and market signal content.

Specific disclaimer: This report includes charts that may reference price levels determined by technical and/or quantitative analysis. No charts will be updated if market conditions change the price levels or any analysis based on them. All charts in this report are for informational purposes only. See the disclaimer for more information.

Disclaimer: No part of the analysis in this blog constitutes a trade recommendation. The past performance of any trading system or methodology is not necessarily indicative of future results. Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS, Email, or Twitter.