If you do not know the answer, or, even worse, if the manager does not know the answer, then you may be in for surprises in the future, pleasant or unpleasant. Most fund managers focus on return and risk as measured by volatility and ignore two other important metrics, kurtosis and skewness. A web search reveals that there are confusing accounts about the significance of those metrics.

Source: Wikipedia

In the above image, the gray line shows a normal distribution and the red curve, a leptokurtic distribution. The most common interpretation of this kind of distribution is that it exhibits “fat tails”. A leptokurtic distribution tells you that risk is coming mostly from outlier events, something that conservative investors may not be very comfortable with. However, other investors may have an appetite for extreme event risk and be looking for such a distribution. For example, according to the BarclayHedge Index, managed futures funds returned 18.16% in 2008, despite the sharp stock market decline because they followed the downtrend in commodities, a rare event caused by the financial crisis.

A leptokurtic distribution involves fat tails. I decided to contact Marc Odo, Director of Applied Research at Zephyr Associates, and seek for his advice. Mr. Odo has done extensive research on this subject and he is kind enough to share his findings. Below is an excerpt from his reply to me:

As to your question about leptokurtic versus platykurtic distributions and which is preferable, originally I took the position that platykurtic distribution where the standard deviation is all generated within a moderate range is preferable. For Zephyr’s audience who are typically longer-term investors who implement using products like mutual funds or ETFs in an asset allocation plan, I believe this makes sense. The goal of these investors is to avoid big surprises, the kind where it turns out their volatility is several times higher than what they are used to seeing.

However, since putting out that paper I have heard a counter-argument. A few people have come to me saying that they seek out leptokurtic distributions IF that distribution is skewed positively. That bit about positive skewness is key. These kinds of investors are looking for the home run. If all of the standard deviation comes from a huge pop in the returns and you’re able to capture that rare-but-large event on the upside, then you’re golden. I’ll admit that I hadn’t considered that initially and for certain investors those characteristics coupled together could make sense. But for the more strategic, buy-and-hold, asset allocation type investor I would think surprises are unwelcome.

Before going into the details of the email response, let us briefly review the notion of a platykurtic distribution. In the above image, a platykurtic distribution is shown by the blue curve. This is a distribution with fewer tail events.

According to Marc Odo and his extensive research, those that opt for a leptokurtic distribution with a positive skew are looking for a home run. Conservative long-term investors who are well-diversified, will look for a platykurtic distribution with as much positive skew as possible. The skewness of a distribution measures the amount of symmetry of returns around the mean and essentially tells us how it is impacted by outliers. A positive skew tells us that the distribution is dominated by positive surprises and a negative skew by negative ones.

Marc Odo’s work is comprehensive and written in a way that can be understood by professionals and investors with basic statistical knowledge. I think an important corollary of his work is that return and risk do not provide enough information about the fund manager’s style. One must also look at the volatility of the volatility (kurtosis) and the asymmetry of returns (skewness). If the distribution is leptokurtic and has a negative skew, then he might have been just lucky or very successful so far in dealing with extreme events and compensating for their negative impact on returns.

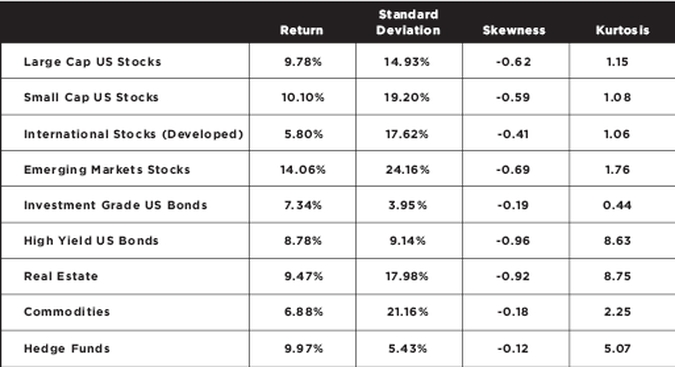

Marc Odo and his company have also produced fact sheets about the different distributions with lots of graphs, stats, and explanations. Below is a table from one of the fact sheets that shows kurtosis and skewness numbers for different markets:

For example, hedge fund risk is lower than US large cap risk, but the high kurtosis of the former market tells you that rare events are of the extreme type. Real estate shows the highest kurtosis with a high negative skew. Investment grade US bonds show normally distributed returns with low skewness.