The overnight anomaly, or overnight effect, in SPY ETF, fell more than 30% during the recent market crash. Has this persistent market anomaly in the last 27 years finally disappeared? Here are some thoughts.

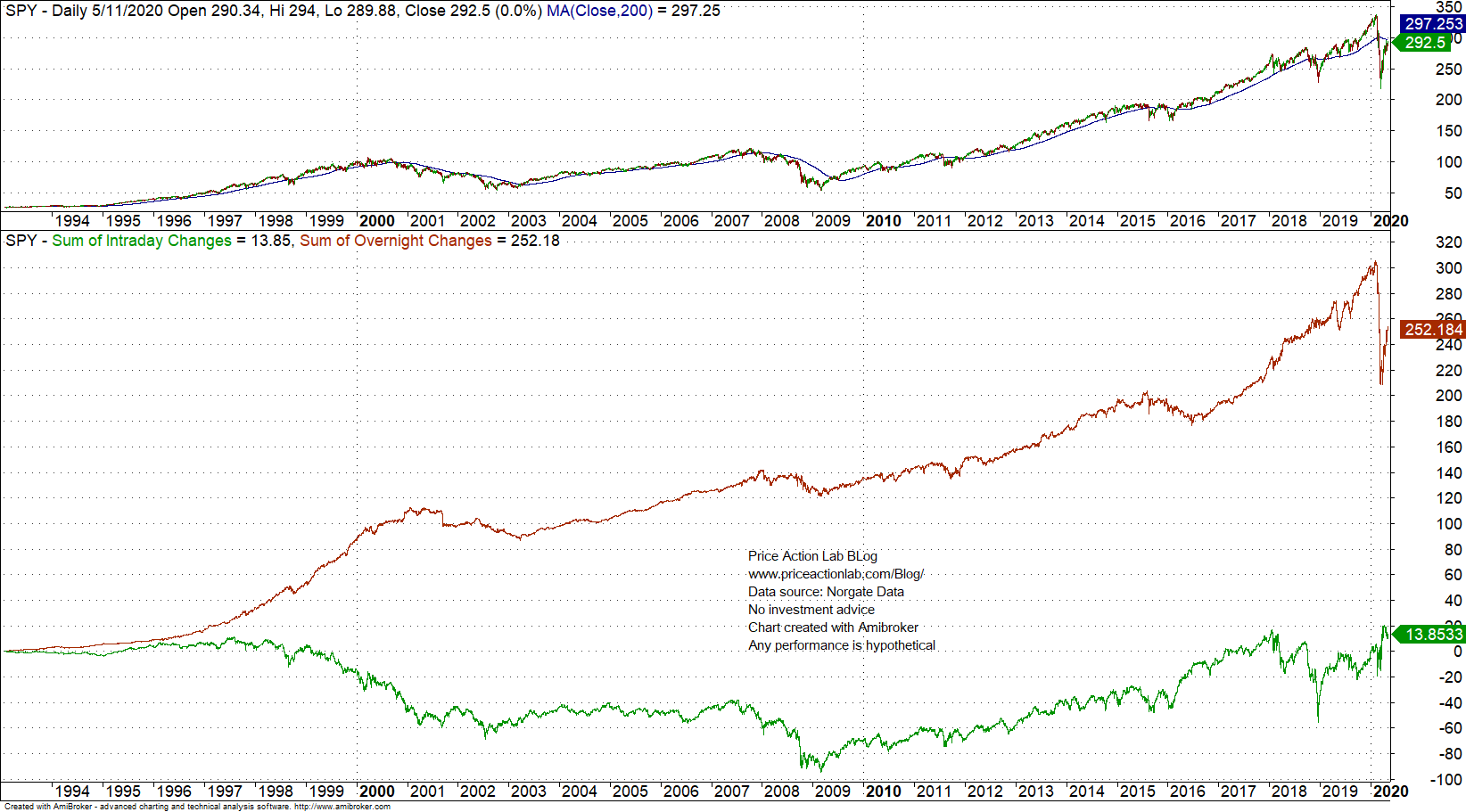

Below is a chart that shows this persistent anomaly since SPY inception.

The red line shows the overnight changes accumulation and the green line the regular trading hours accumulation, As reported in this blog in several articles before, virtually all gains in this ETF have been due to overnight gaps.

However, during the recent market crash the overnight gains fell as much as 31% and the drawdown at this point is about 24%.

Is this price anomaly disappearing? This is possible. We warned our blog readers back on March 18 about this change in trend with this article.

Although some may claim this is a structural anomaly, most market anomalies turn less robust or disappear when they become a popular “trading edge.” At some point the market cannot deliver profits to all participants that try to exploit the edge. Although the anomalies may reappear at some point in time, they no longer offer a “robust” edge and pose high risks.

Another example of a widely publicized edge is the RSI2 mean-reversion strategy discussed in more detail in this article. As it may be seen from the equity chart below, the standard form of this strategy has ceased is under stress since October 2018. Current drawdown is about 24%.

Year-to-date, RSI2 with standard settings is down 15.5%. The failure of RSI2 does not mean mean-reversion has ceased to deliver profits. Below is an equity curve that shows how our proprietary PSI5 mean-reversion algo has continued to perform well even amid high uncertainty. This algo is based on a formula from probability theory. Year-to-date PSI5 strategy is up 4.4%.

Edges come and go and how fast they deteriorate depends on how many are trying to profit from them. Traders, but also investors, who rely on public “edges” at some point in time face losses as the trade gets too crowded. This is inevitable as the market dislikes crowded trades.

Finding an edge and keeping it proprietary or at least limiting the number of participants that try to take advantage of it is important to success, unless one is doing buying and holding. Strategies and investing methods discussed in popular books, magazines and blogs become less robust or even unprofitable. Understanding this is 50% of the edge. The other 50% is achieved through the hard work to find a proprietary edge.

Charting and backtesting program: Amibroker

Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS or Email, or in Twitter