The PSI5 mean-reversion strategy in SPY ETF is up 15.79% year-to-date after recovering from the March drawdown.

The PSI5 mean-reversion strategy is not a data-mined but instead based on a formula from a text in probability theory that models price action.

PSI5 strategy in SPY ETF backtest details

Time-frame: Daily (adjusted data)

Strategy type: Long-only

Market: SPY ETF

Backtest period: 01/04/1993 – 08/28/2020

Commission per share: $0.01

Position size: Fully invested

Position entry and exit: Open of next bar

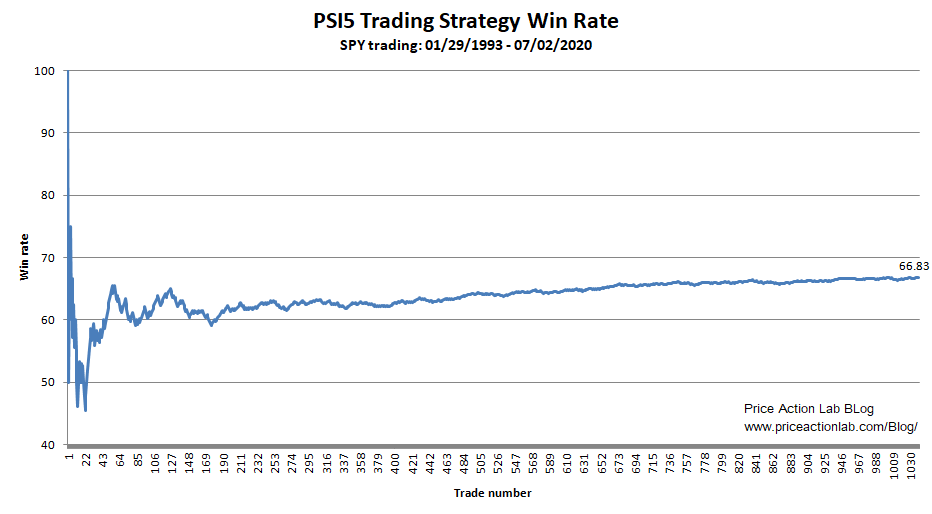

. Below is a graph of win rate as a function of trade number from 01/29/1993 to 07/02/2020:

The win rate of mean-reversion strategies is an important t metric because usually the payoff ratio is smaller than 1, as opposed to momentum strategies where the payoff is much higher than 1 and lower win rate can be tolerated. The win rate of PSI5 strategy in SPY has been steadily rising after initial stabilization by a sample of about 400 trades and is about 67% as of August 28, 2020.

A few comments about mean-reversion strategies

Mean-reversion strategies are risky because by design the signals go against the short-term trend. Stop-loss usually destroys profitability and cannot be used.

Mean-reversion strategies are for professional traders that understand risk and can manage it well.

Amateur traders can lose money even when using a profitable mean-reversion strategy because of fear to take signals that go against the short-term trend.

Usually, professionals allocate a small percentage of capital to mean-reversion strategies.

Charting and backtesting program: Amibroker

Data provider: Norgate Data

More information about PSI strategy:

PSI mean reversion strategy information.

If you found this article interesting, you may follow this blog via RSS or Email, or on Twitter