The rules of the volatility trading strategy are available as a bonus with the strategy bundle.

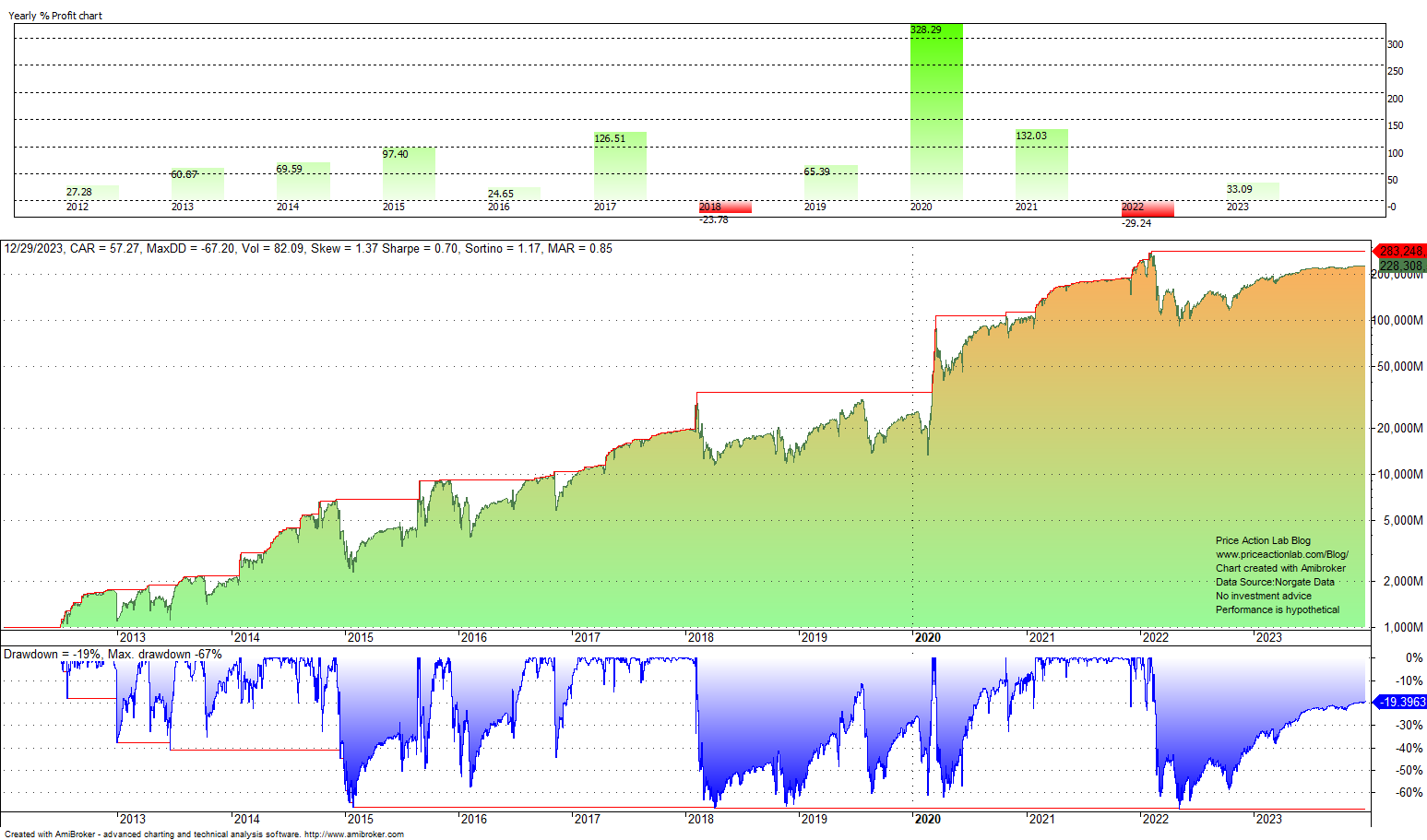

The strategy trades UVXY long/short in the daily timeframe. All positions are entered at the next open after the signals are generated. This strategy is not data-mined. The period of all backtests is from 01/03/2012 to 12/29/2023. No commissions are included.

The strategy shows in backtests potential for high reward but at very high risk. This type of strategy is suitable only for experienced traders who understand market risk and can manage it well. Usually, the allocation to high-risk strategies is small.

Performance

The annualized return is 58.5%, but it comes with high volatility and a maximum drawdown of 83% and -67%, respectively. The Sharpe is 0.70. There are 139 trades (69 long and 70 short), and the win rate is 48.9%. The largest return is 328% for 2020.

The rules of the volatility trading strategy are available as a bonus with the strategy bundle. Contact us for details.

|

This post is for paid subscribers

Already a subscriber? Sign in |

Click here for a list of strategies.

Disclaimer: No part of the analysis in this blog constitutes a trade recommendation. The past performance of any trading system or methodology is not necessarily indicative of future results. Read the full disclaimer here.

Charting and backtesting program: Amibroker

Data provider: Norgate Data