This is a simple strategy for trading Dow 30 stocks with no parameters to optimize and no filters. The strategy has outperformed the SPY ETF annualized return since inception by a wide margin, with a Sharpe of more than 1. Updated: December 29, 2023. Click here for the performance update to March 20, 2024.

For all backtests in this article, we used Norgate data for the Dow 30 index, which includes current and past constituents. We highly recommend this data service (we do not have a referral arrangement with the company).

Timeframe: Daily (adjusted data)

Index: Dow 30 (current and past constituents)

Strategy type: Long-only mean-reversion

Maximum open positions: 10

Position size: equity/10

Commission: $0.005/share

All trades are executed at the open of the next bar

Backtest range: 01/02/1993 –12/29/2023

Comments

- The backtest starts in 1993 to allow a sufficient sample.

- The strategy has no varying parameters and no price action filters.

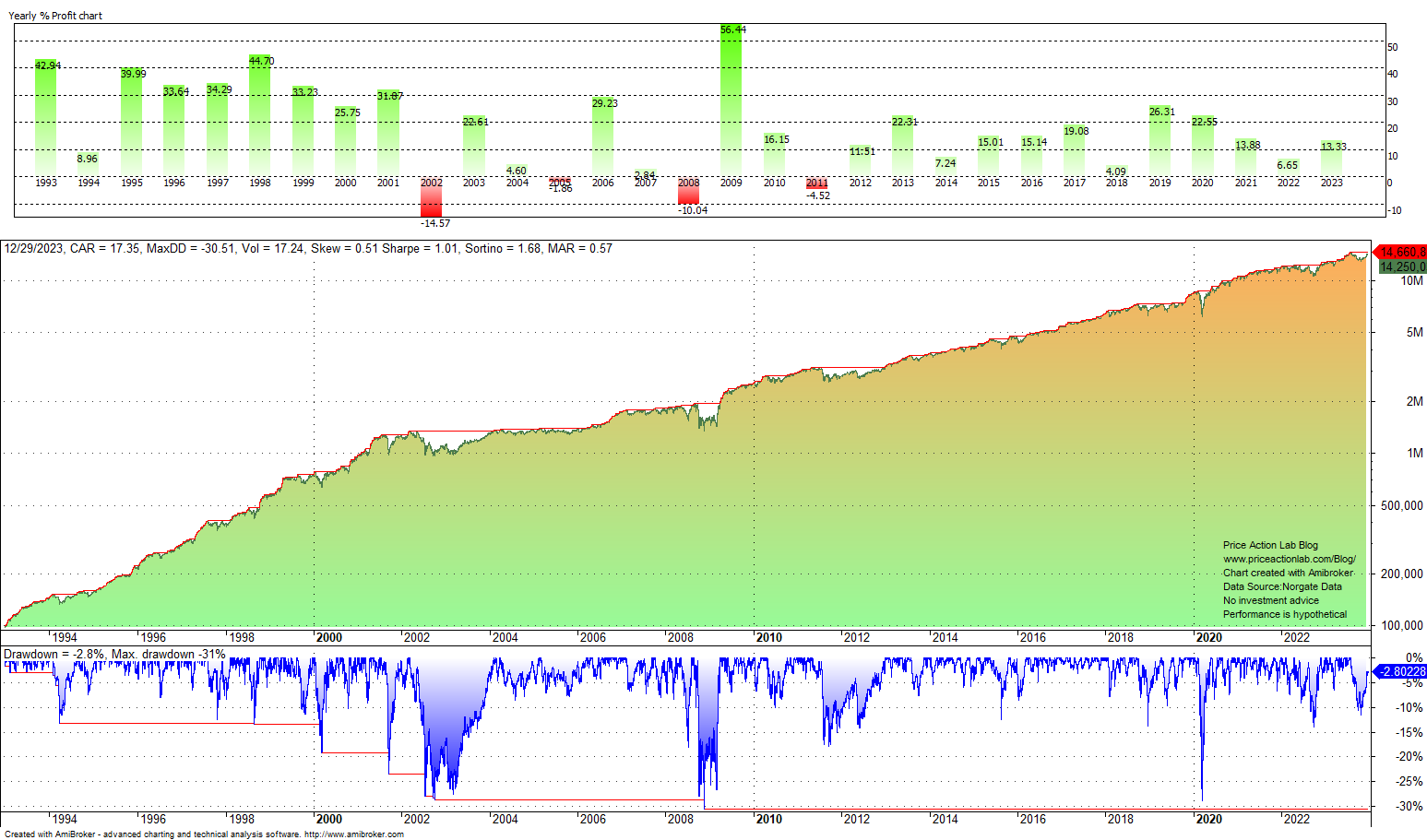

Equity curve, yearly returns, and drawdown profile.

Performance Summary

| STRATEGY | |

| CAGR | 17.3% |

| MDD | -30.5% |

| SHARPE | 1.00 |

| VOLATILITY | 17.3% |

| TRADES | 11,102 |

| WIN RATE | 65.5% |

| AVG. BARS IN TRADE | 6.9 |

| EXPOSURE | 82.5% |

The strategy’s CAGR is 17.3%. The maximum drawdown of the strategy is -30.5%. The Sharpe of the strategy is 1.00 versus 0.53 for buy and hold in the same period.

The average holding period is 6.9 days, and exposure is 82.5%. The strategy has generated about 11,000 trades in the test period. In 2022, the strategy gained 6.7% versus a loss of 18.5% for the SPY ETF.

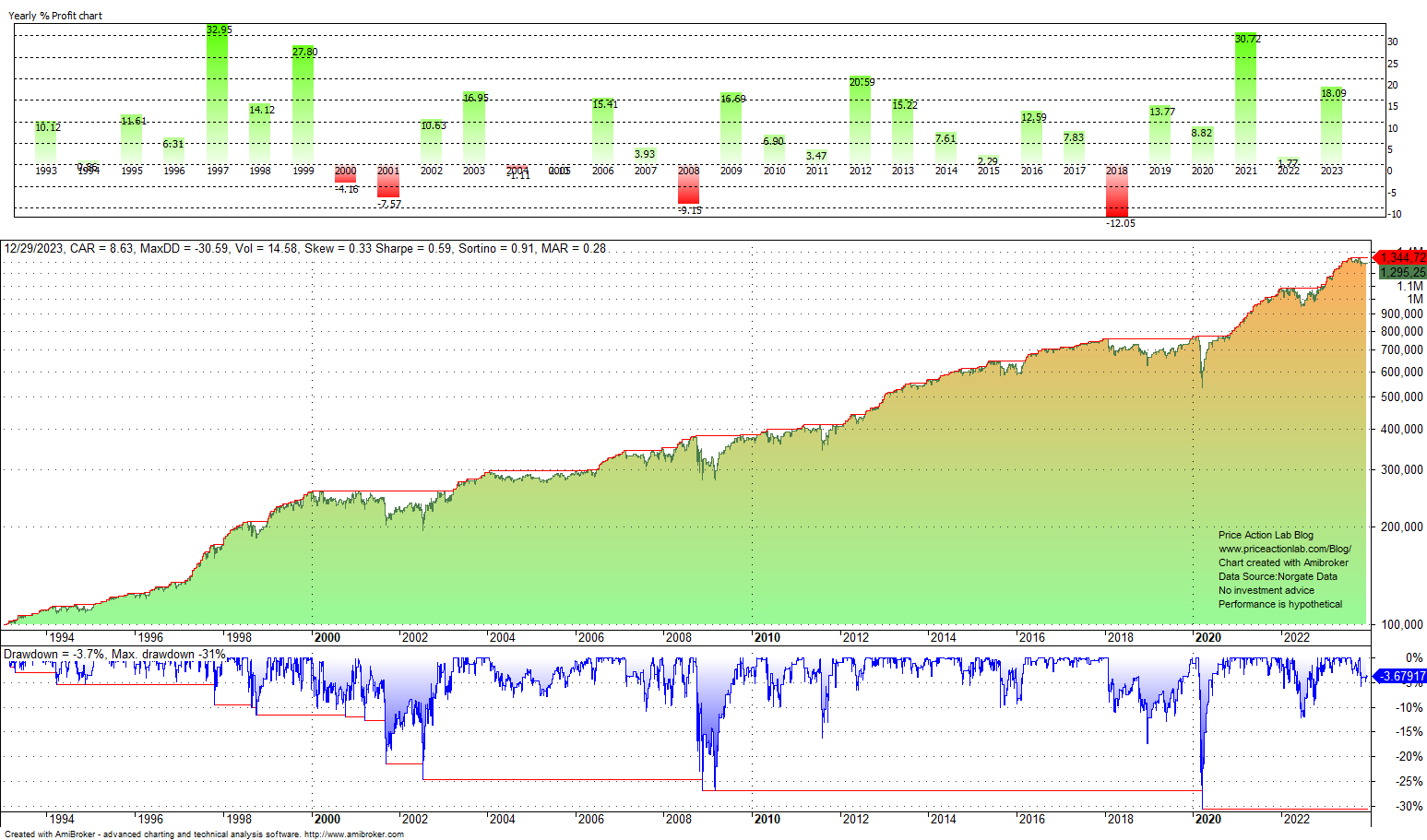

SPY ETF Performance

Below is the equity curve with yearly returns, and the drawdown profile, when using the B2S2 strategy to trade SPY ETF from inception to December 29, 2023.

This simple, long-only strategy gained 1.7% in 2022, versus a loss of 18.5% for the SPY ETF, and also gained 18.1% in 2023. The annualized return is 8.6%, the win rate is 68.7%, and the number of trades is 617 since the inception of the SPY ETF.

The rules of the strategy are available separately or as part of a bundle of eight strategies. Contact us for more details and prices. Instructions for unlocking the restricted content below are emailed after payment is received.

|

This post is for paid subscribers

Already a subscriber? Sign in |

Click here for a list of strategies.

About the risks of mean-reversion strategies

Mean-reversion methods are risky since the trades typically go against the short-term trend. Stop-loss orders cannot be employed efficiently because, in the majority of instances, they destroy profitability.

Mean-reversion strategies are only good for experienced traders who know how to manage risk and are willing to take on big risks.

When using a profitable mean-reversion strategy, inexperienced traders may lose money because they are afraid to act on signals that are risky at first but pay off in the long run.

Disclaimer: No part of the analysis in this blog constitutes a trade recommendation. The past performance of any trading system or methodology is not necessarily indicative of future results. Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS, Email, or Twitter