Some traders classify trading strategies as convergent or divergent. Trend-following strategies can be both convergent and divergent.

Convergence and divergence are two terms often used in technical analysis to describe how price moves relative to an indicator. If the price and the indicator move closer to each other, there is convergence, and if they diverge from each other, it is divergence, positive or negative.

Some traders have attempted to apply a similar classification to trading strategies: those that profit from divergence (referred to as trend-following) and those that profit from convergence (often referred to as mean-reversion). This classification assumes some independence of the two notions, i.e., convergence and divergence. But are they independent, or even clearly defined?

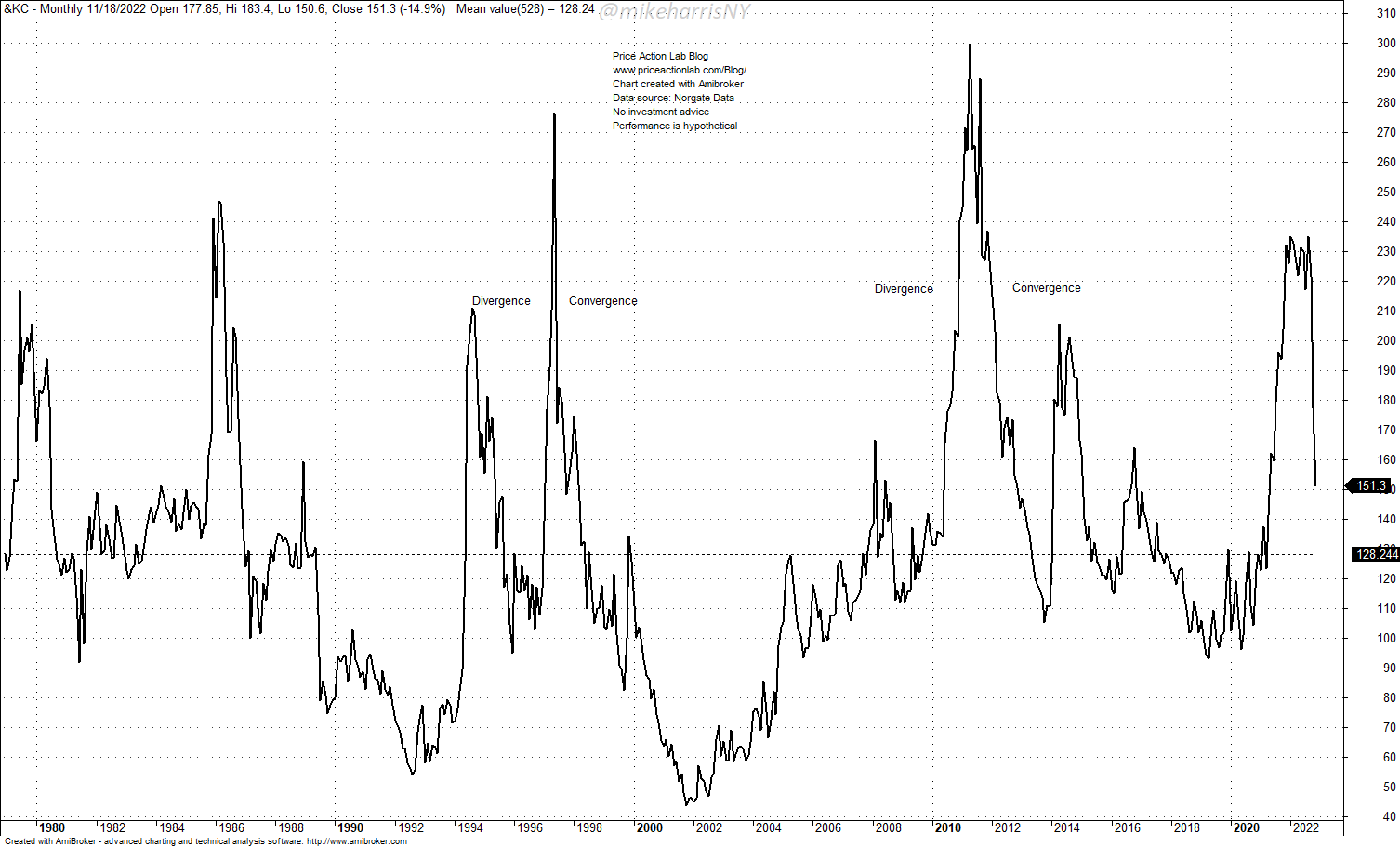

It’s early in the morning and for this reason, I chose the monthly continuous coffee futures chart to illustrate why the convergent/divergent classification does not make any sense unless it is specifically coupled to the time frame.

The dotted line is the mean price of the continuous futures contract. I have marked two sets of divergent moves followed by convergence to the mean. A trend-following strategy with a long position during the divergent moves would satisfy the “divergent” classification but a reversal to short during the convergent moves would satisfy the “convergent” classification.

In other words, the convergence/divergence classification fails in the simplest case of uptrends away from some mean value followed by downtrends towards the same value: the same trend-following strategy is both divergent and convergent.

We can force the classification of trading strategies as convergent or divergent if we introduce a time frame and some specific measures of what it is we are converging or diverging from. For example, we can talk about converging or diverging from a trend.

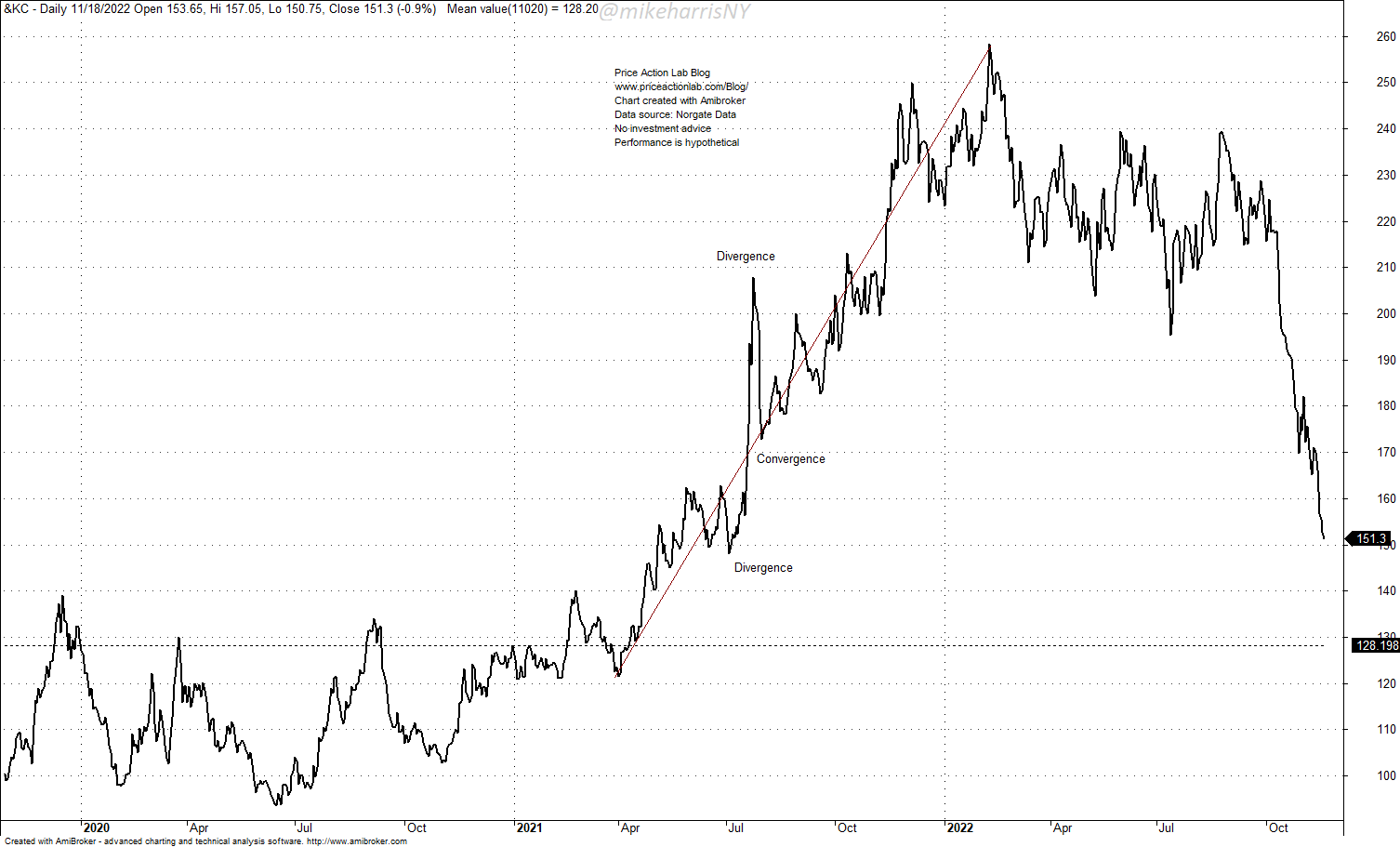

Below is the recent price action in continuous coffee futures in the daily timeframe.

The red line indicates an uptrend in prices. I have marked two divergences and their convergences to the uptrend. A short-term trading strategy could attempt to buy the dip and/or short the rip, and exit at the trend level. This is often called mean-reversion trading and in this case, the mean is the trend. Mean reversion encompasses a wide variety of strategies depending on how it is defined:

- Reversion to an indicator (for example, a moving average).

- Reversion to a price level.

- Reversion from overbought to oversold and the other way.

- Reversion due to negative autocorrelation (daily timeframe).

- Statistical arbitrage and pairs trading.

- Long-term fundamental reversion.

The last one, number 6, is similar to the short positions taken by long-term trend-following systems. Going back to the monthly coffee chart, a trend-following strategy may signal a short position while a strategy based on fundamentals may take a similar position due to supply/demand considerations that point to a reversion to some price equilibrium level. In reality, trend-following strategies can be both convergent and divergent depending on the time frame.

The above was clearer back in the times when trend-following meant using a 10-day or 21-day moving average to track price, or in general a fast-moving average. As competition increased due to no barrier to entry in the CTA space, markets became more volatile and the moving average or breakout periods had to be increased to minimize realized losses but at the penalty of larger drawdowns. During those early trend-following days, the distinction convergent vs. divergent strategies was not relevant. But as the time-frames increased, traders following stock moves with long-term targets started calling their strategies divergent. However, as I demonstrated above with examples, at this point the distinction makes sense only in the case of short-term mean-reversion systems and trend-following systems can be both divergent and convergent.

Subscribe for free notifications of new posts and updates from the Price Action Lab Blog and get the PDF book “Profitability and Systematic Trading” (Wiley, 2008) free of charge.

Disclaimer: No part of the analysis in this blog constitutes a trade recommendation. The past performance of any trading system or methodology is not necessarily indicative of future results. Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data