The long-only mean-reversion strategy for trading SPY and QQQ is based on two popular indicators.

The strategy rules are available with a purchase of the strategy bundle.

Backtest settings

Name of strategy: MRFREE

Timeframe: Daily (adjusted data)

Markets: SPY and QQQ ETFs

Strategy type: Long-only mean-reversion

Position size: 100% of available equity.

Commission: $0.01/share

Execution: All trades are executed at the open of the next bar

Backtest range: 01/3/2003 –12/29/2023

Note that the strategy is not optimized for the highest annualized return.

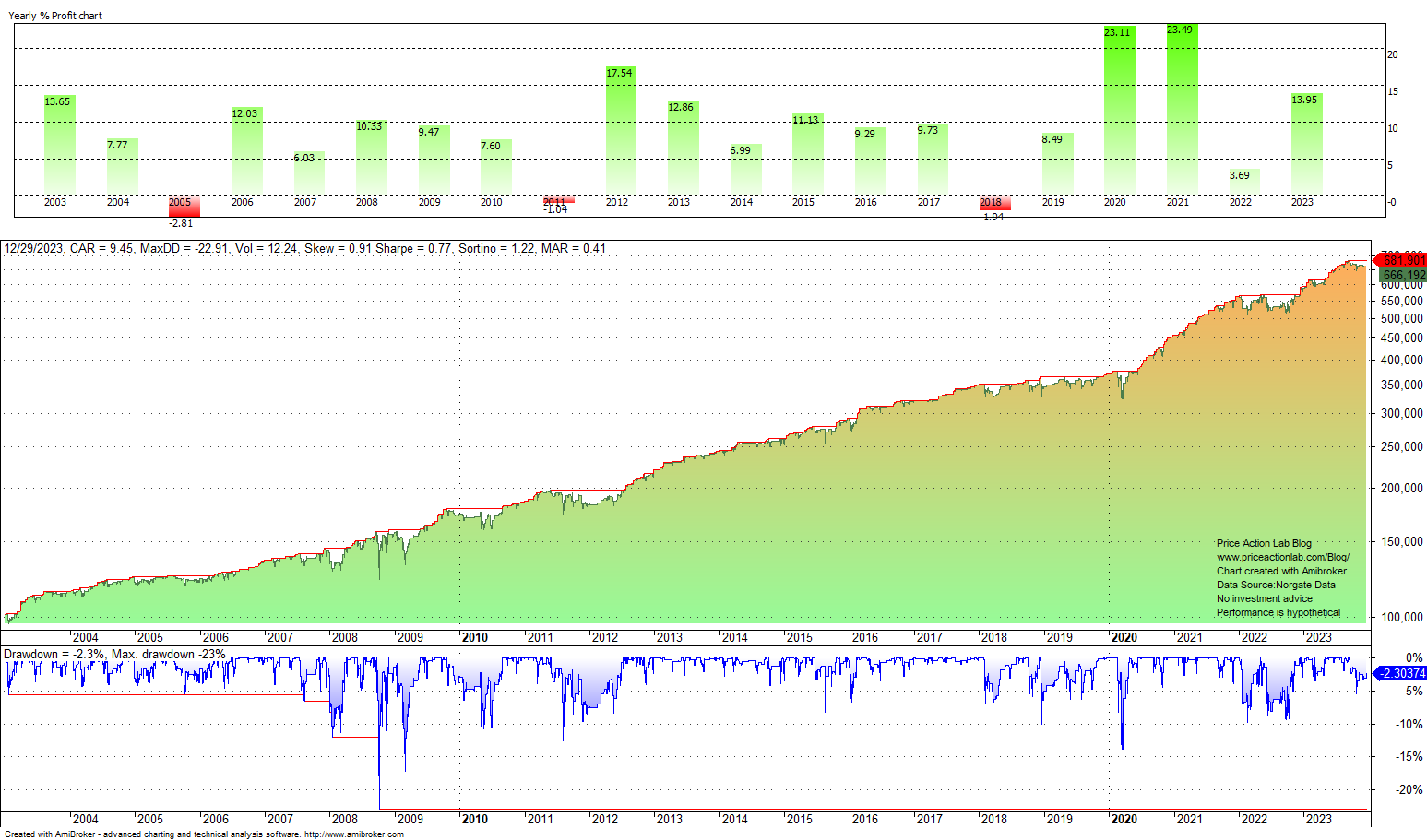

Equity curve, yearly returns, and drawdown profile

The annualized return is 9.4%, and Sharpe is 0.77. The win rate is 69.1%.

Performance Summary

| STRATEGY | |

| CAGR | 9.4% |

| MDD | -22.9% |

| VOLATILITY | 12.1% |

| SHARPE | 0.77 |

| TRADES | 910 |

| WIN RATE | 69.3% |

| AVG. BARS IN TRADE | 4.4 |

| EXPOSURE | 30.0% |

Strategy rules

|

This post is for paid subscribers

Already a subscriber? Sign in |

Click here for a list of strategies.

About the risks of mean-reversion strategies

Mean-reversion methods are risky since the trades typically go against the short-term trend. Stop-loss orders cannot be employed efficiently because, in the majority of instances, they destroy profitability.

Mean-reversion strategies are only good for experienced traders who know how to manage risk and are willing to take on big risks.

When using a profitable mean-reversion strategy, inexperienced traders may lose money because they are afraid to act on signals that are risky at first but pay off in the long run.

Disclaimer: No part of the analysis in this blog constitutes a trade recommendation. The past performance of any trading system or methodology is not necessarily indicative of future results. Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS, Email, or Twitter