Some economists are claiming victory for their predictions of no recession this year. Tossing a fair coin is hardly a prediction and does not justify a victory lap.

Some economists predicted a recession this year, while others insisted there would not be one. The common denominator in these predictions was that the economists had no idea how far the Fed would hike interest rates; it is mainly the level of rates that determines whether the economy enters a recession. Therefore, these economists tossed coins while looking in the rearview mirror. It is fair to say that not all economists do that; some excellent ones understand the difference between the economy and politics.

Rate levels, along with accommodating some level of inflation, are political decisions. This is not the subject of forecasting. Economists should know better, especially after the spectacular failure of inflation predictions due to quantitative easing at the start of the last decade.

The economy has not entered a recession because the central bank is gambling. First, they thought (or just insisted) the inflation was transitory; that was a huge gamble. Then they raised rates to avoid inflation getting out of control, but not high enough to kill it. That was a second gamble they took.

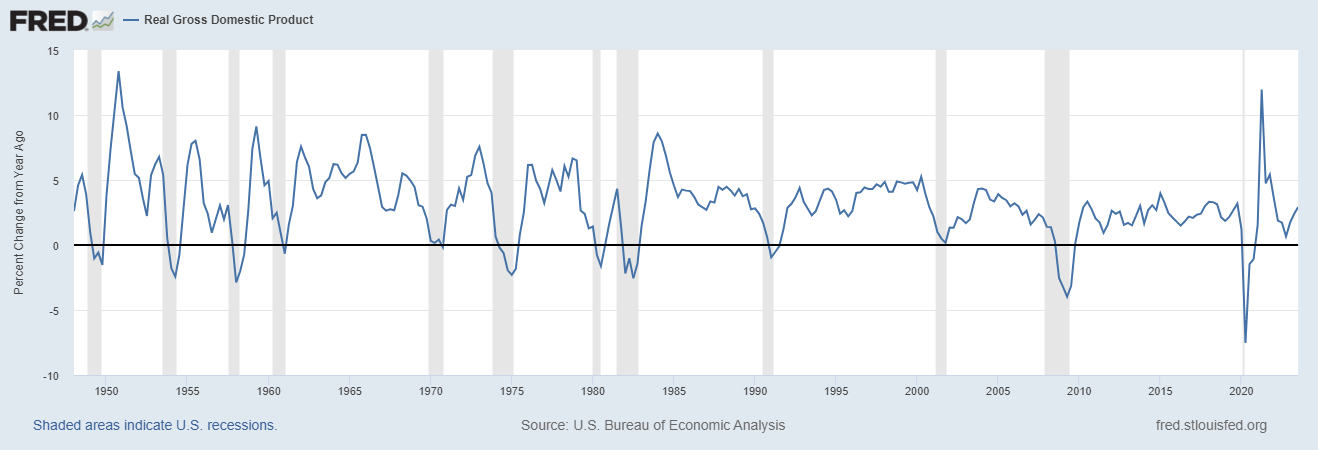

The US economy is not in a recession due to political decisions on how to deal with inflation. Amid wars and geopolitical instability, a recession would cause irreparable political and financial damage. It was not the analysis of the data that allowed some economists to forecast no recession, but rather the political decision not to deal with yield curve inversions the “recommended way”, which was a confounding factor. With inflation as high as 3.7% after nearly two years since it started rising, it is reasonable to expect a real GDP of around 3%.

Real GDP can go negative in the blink of an eye if the Fed decides so. It is all politically driven. If that was not made clear in university, maybe people should ask for their money back for the economics course with interest.

Now imagine where real GDP would be had the Fed raised rates to 7%, as it should have, in my humble opinion. Because the risk here is another inflation cycle. We avoided a recession, but at what cost? Do you think consumers believe the mainstream media stories about nearly abundant purchasing power? How much of that is credit and borrowing from the future, since everyone understands that during high inflation there is a transfer of wealth from lenders to borrowers?

Wait a minute! Did I just say “transfer of wealth?” Maybe we should let inflation go higher. The only robust way to reduce income inequality is through inflation, except when the banks stop lending and buy paper assets.

The logic matters, the premises matter, as well as the conclusions. If the conclusions are disconnected from the premises, the logic is not sound. Economists can try to make forecasts, but the key input, which is the level of interest rate, is unknowable, although the central bank tries to provide some guidance.

Victory laps are unwarranted. In a game of tossing a fair coin, someone will get heads and someone will get tails. Imagine bragging about the outcome.

Price Action Lab Blog Premium Content

Subscribe for immediate access to hundreds of articles. Premium Articles subscribers have immediate access to more than two hundred articles, and All in One subscribers have access to all premium articles, books, premium insights, and market signal content.

Disclaimer: No part of the analysis in this blog constitutes a trade recommendation. The past performance of any trading system or methodology is not necessarily indicative of future results. Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS, Email, or Twitter.