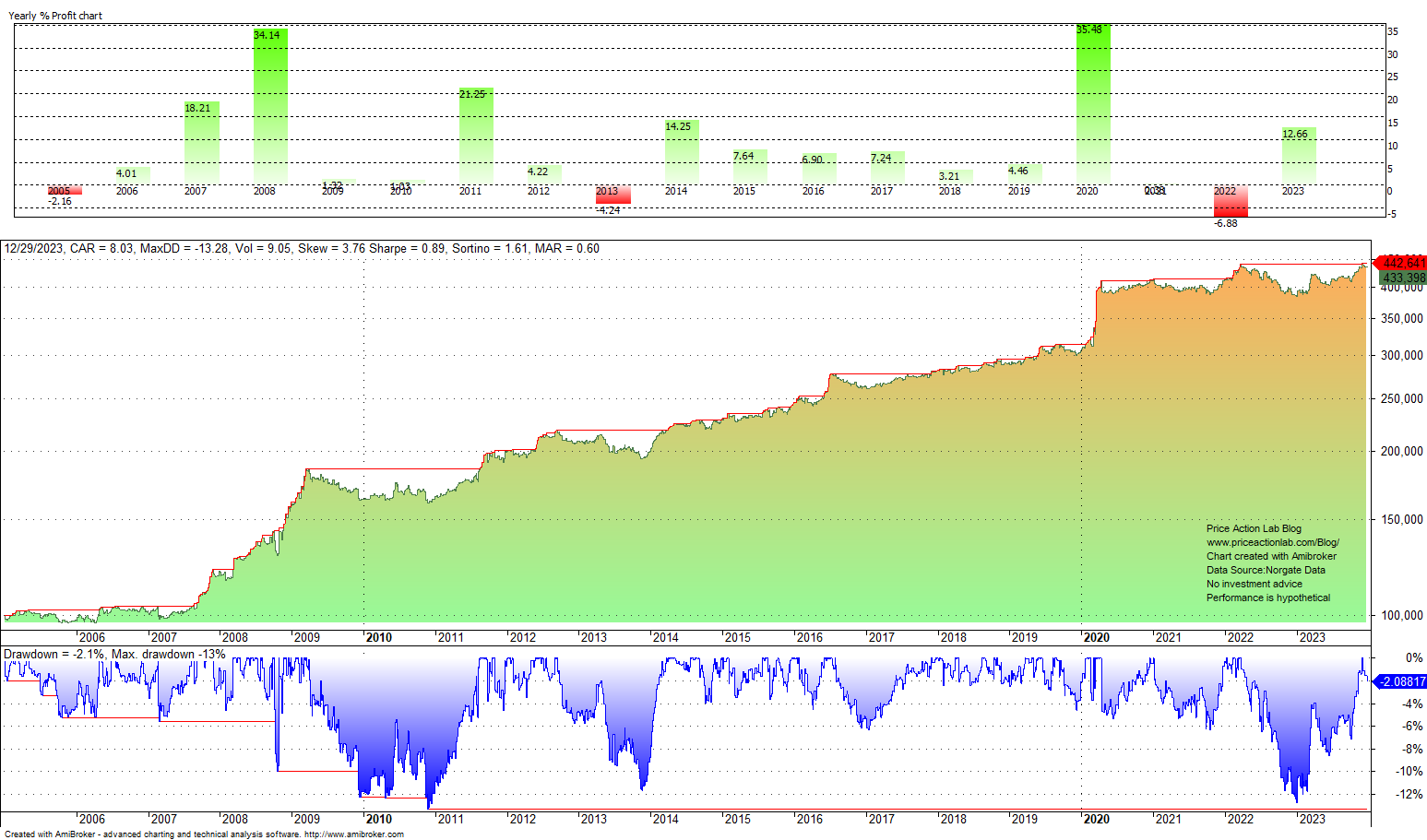

The ETF seasonality strategy trades long-only SPY, TLT, and GLD ETFs. Updated: December 29, 2023

Backtest Results

Markets: Three popular ETFs

Commission: $0.01/share

Timeframe: Daily

Backtest period: 01/03/2005-12/29/2023

No leverage

Backtest statistics

| Annualized return | 8.10 |

| Maximum drawdown | -13.3% |

| Volatility | 9.1% |

| Sharpe ratio | 0.89 |

| Skew of equity curve | 3.76 |

| Skew of trade P/L | 0.90 |

| Number of trades | 2,322 |

| Win rate | 54.9% |

| Payoff ratio | 1.06 |

| Average holding period (days) | 1 |

| Exposure | 28.5% |

With an exposure of only 28.5% and a holding period of one day, this strategy has had an annualized return of 8% since 2005. The maximum drawdown is 13.3%, and the Sharpe ratio is 0.89. The skew of both the trade P/L and equity curves is positive. These statistics make this strategy a potential diversifier.

The strategy (ETFSEAS) rules are available to strategy bundle subscribers. Contact us for details.

Strategy rules

|

This post is for paid subscribers

Already a subscriber? Sign in |

Click here for a list of strategies.

About the risks of seasonality strategies

Seasonality strategies are risky because price action anomalies may disappear at any time.

These strategies are only good for experienced traders who know how to manage risk and are willing to take on big risks.

When using a profitable seasonality strategy, inexperienced traders may lose money because they are afraid to act on signals that are risky at first but pay off in the long run.

Disclaimer: No part of the analysis in this blog constitutes a trade recommendation. The past performance of any trading system or methodology is not necessarily indicative of future results. Read the full disclaimer here.

Charting and backtesting program: Amibroker. Data provider: Norgate Data

If you found this article interesting, you may follow this blog via RSS, Email, or Twitter