Market recap, open positions, new signals, and performance of six trading strategies. Tactical asset allocation, mean-reversion, cross-sectional momentum, and equity long-short. Access the full report with a Market Signals or All-in-One subscription.

Reminder: The monthly updates for HAA and DYNMOM signals are free for Market Signals subscribers. The next update release will be on Thursday, February 1, 2024. Click here for more details.

Contents

1. Market Recap and Comments

2. Ensemble Performance

3. Positions and Performance of Strategies

4. Signal Summary for Next Week

1. Market Recap and Comments (January 22–January 26, 2024)

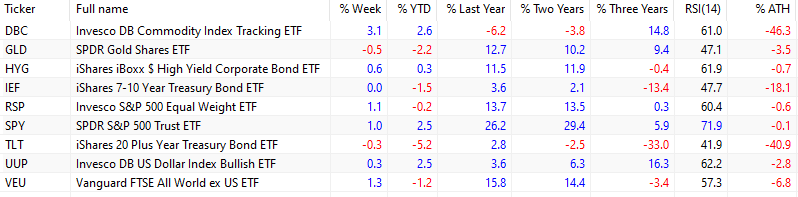

This week, the energy sector was the big winner on the back of rising tensions in the Middle East, with the spot price of crude oil jumping 6.5%. The DBC ETF, which has a high correlation with crude oil, gained 3.1%. Despite the geopolitical turmoil, gold fell 0.5% for the week, but international stocks (VEU) gained 1.3%.

Large-cap stocks (SPY) were up 1% on the week, with energy, communications, and financials leading. The US dollar (UUP) gained 0.3%, but long-duration bonds (TLT) were down 0.3%. With strong growth and employment, the probability of a March rate cut fell, and that has put the brakes on the bond market rebound. The market forces of last week remained in place, as noted in last week’s report:

Stocks gained due to robust growth, but bonds fell due to worries about a resurge in inflation and uncertainty about the timing of rate cuts.

Since January 2022, the SPY ETF has been up 5.9%, but with a maximum drawdown of 24.5%. Gold and the US dollar have outperformed large-cap stocks in the same period. Specifically, spot gold has been up 10.9%, and the US dollar index has been up 8.1%. Note that the UUP ETF has surged 16.2%, for reasons explained in this article.

The activity in financial social media reveals that many traders have started picking stocks they think will outperform or even offer quick gains. Although we have not yet reached the activity levels during the dot-com irrational exuberance, if we also add the options markets, then speculation has reached new all-time highs. However, as in the past, the majority of speculators will transfer their wealth to professional market participants.

Trading is hard, especially if the goal is to make money, and a large fraction of traders are of the recreational type. With strategy ensembles, we attempt to transform distributions of market returns that involve high risks into “less risky” ones. This practice leads to underperformance when there are strong market rebounds, but it is a sound method of preserving wealth, reducing risks, and realizing a reasonable long-term return.

2. Ensemble Performance

Access the full report with a Market Signals or All-in-One subscription. By subscribing, you have immediate access to hundreds of articles. Market Signals subscribers have immediate access to hybrid asset allocation and dynamic momentum monthly signals and more than two hundred articles in the Premium Education section, and All in One subscribers have access to all premium content (except daily mean-reversion signals.)

|

This post is for paid subscribers

Already a subscriber? Sign in |

Ultimate Trading Package

Charting and backtesting program: Amibroker. Data provider: Norgate Data

Disclaimer: The Premium and Weekly Signals are provided for informational purposes only and do not constitute investment advice. We do not warrant the accuracy, completeness, fitness, or timeliness for any particular purposes of the Premium and Weekly Signals. Under no circumstances should the Premium or Weekly Signals be treated as financial advice. The author of this website is not a registered financial adviser. Before subscribing, please read our Disclaimer and Terms and Conditions.

Copyright notice: Any unauthorized copy, reproduction, distribution, publication, display, modification, or transmission of any part of this report is strictly prohibited without prior written permission.