Strategy Development Based on Short-Term Price Action Anomalies

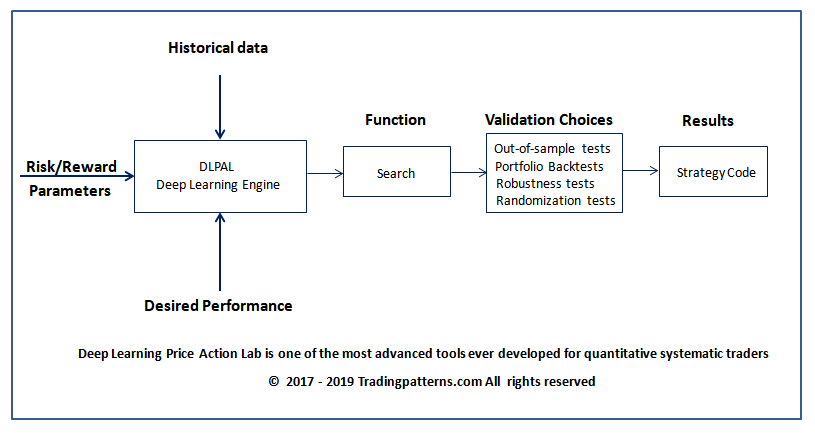

DLPAL S was designed for trading strategy developers that follow systematic signals and it is easy to use. No programming is necessary. DLPAL S generates code for strategies and systems of strategies.

DLPAL S generates code for strategies and systems for the Quantopian platform, Tradestation (EasyLanguage), Multicharts (EasyLanguage), NinjaTrader (7 and 8), and Amibroker AFL. Several validation methods are available for testing the significance of the results.

In the daily timeframe, the system tracking module of the program can be used to monitor the signal generation of the strategies and systems going forward in time and as new data are available.

DLPAL S does not require any programming. The program will output signals and write code you can immediately use in the analysis. Save time from programming and concentrate on your trading.

DLPAL S is a quantitative analysis tool. DLPAL S will not find strategies that work in all markets especially if the markets are efficient and price action is dominated by noise. DLPAL S will not create final systems for auto trading. The user of the software has to put in the work necessary for developing a final trading system according to desired criteria and risk/reward objectives. Trading strategy development is difficult and time-consuming, and success is not guaranteed.

Note: DLPAL S is no longer updated and the last stable version is available.

DLPAL S Strategy For Bitcoin Futures

Train, Test, and Validation Steps In Developing a Strategy with DLPAL S

Trading Strategy for Gold Futures

Process Integrity vs. Strategy Performance

DLPAL S Strategy for 10-Year Note Futures

DLPAL S Deep Add-On Update

High Accuracy Predictions Are Not Always Profitable

Strategy Validation Without Out-Of-Sample Testing

ETF Portfolio Trading with DLPAL S

Announcing the Release of DLPAL S v3

Unleashing the Power of DLPAL S Price Action Anomaly Detection

Robustness Testing of Data Mining Process

Walk Forward Strategy Development

Using DLPAL S to Discover Volume Patterns

Deep Search Add-on For DLPAL S

Using Portfolio Backtests To Reduce Selection Bias

Validating DLPAL S Trading Strategies On Comparable Securities

Developing A Trading Strategy For TLT ETF

DLPAL Strategy For GLD With Validation in TLT and SPY

DLPAL Strategy For Trading EURUSD With Backward Validation

Adjusted Vs. Unadjusted Data In Trading Strategy Development

Best Lookback Period in Position Trading With Price Patterns